Introduction

Accounting software has improved significantly over the last 20 years, with much of the benefit coming from the move towards cloud from desktop solutions.

There’s no doubt, many of the main cloud accounting providers out there do a great job for the typical small/medium sized business, but for many, they remain on such software for far too long.

As a result, lots of unnecessary labor hours (including that of senior staff) are wasted managing spreadsheets, not to mention time spent liaising internally/externally with colleagues and counterparties.

In this article, we will discuss some common problems to look for which could indicate that your business has outgrown its current accounting software.

We will then demonstrate how SoftLedger can help with such problems.

Problem: Managing Intercompany

Most cloud accounting solutions available only allow 1 business per license.

As a result, even small groups of companies can quite quickly outgrow such software since time must be spent:

- Tracking both sides of transactions raised between companies within the group

- Managing internal consolidation spreadsheets (including eliminations) for group level reporting

- Managing exchange rate calculations for multi-currency consolidations

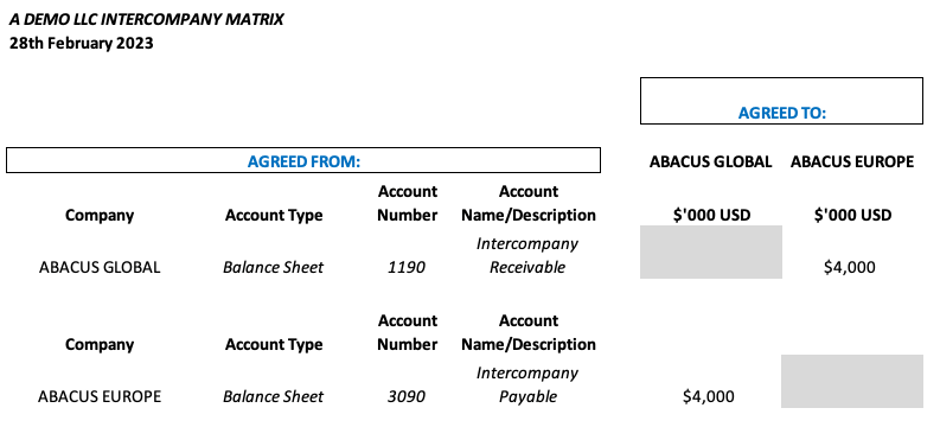

Taking point 1) as an example, many businesses with a standard piece of software, may manage intercompany balances using a standard spreadsheet matrix like below:

Working from Abacus Global’s books on the left, as at the 28th of February 2023, it has a receivable balance due from another group company, Abacus Europe, of $4M USD.

On the flip side, Abacus Europe, on the same date, has a payable due to Abacus Global in respect of this amount.

Each month end, the finance team at Abacus must manually update the matrix and physically check that the balances across the group (of which there are many across a number of companies) agree – such that they eliminate on consolidation.

Last minute intercompany amendments before reporting deadlines are currently difficult to manage because:

- All entries must be made in the books of 2 separate companies (due to having 1 company per software license)

- The tracking of intercompany balances (using the spreadsheet above) must be manually updated after checking the balances of each company individually

Reporting errors are easy to make where subsidiary level financial statements are issued without the intercompany position fully reconciling.

How SoftLedger resolves these common problems

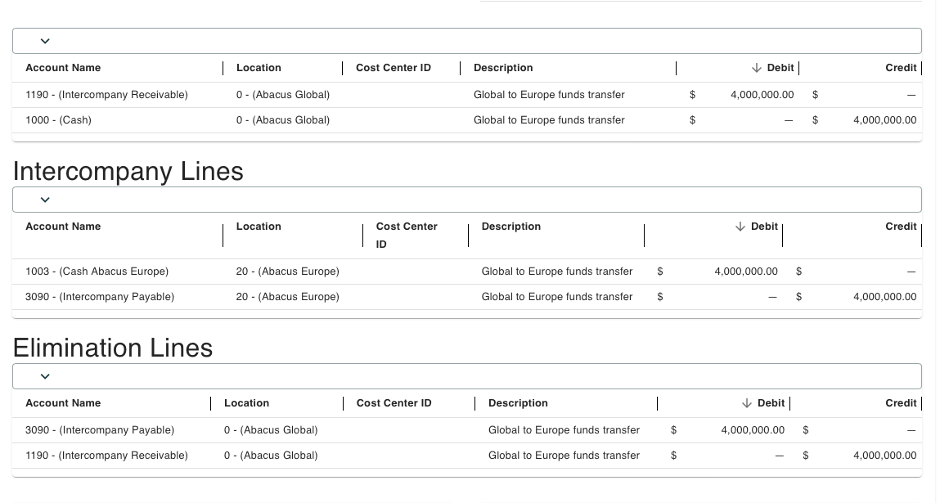

On transfer of the $4M USD from Abacus Global to Abacus Europe, only one entry is needed to record the transaction in both companys’ books.

In addition, the entries are tracked as an intercompany item ready for removal on consolidation.

Journal entries made to SoftLedger:

Working through the journal entries in the screenshot below, from top to bottom, we see:

Note: for a full tutorial video on how to enter an intercompany journal into SoftLedger, please click here.

- The initial entry to Abacus Global’s books (top journal):

Journal entries are made to SoftLedger for the transfer from Abacus Global to Abacus Europe.

On entry of this journal, the user simultaneously specifies the next 2 journals below (i.e. intercompany journal to Abacus Europe and the elimination).

- Entries to Abacus Europe (middle journal):

The “Intercompany Lines” journal shows the entries to Abacus Europe’s books due to the transfer received from Abacus Global.

These entries are automatically defined on entry of the journal above (i.e. through designating them as the opposite to the transfer from Abacus Global).

- Elimination Lines

Shows the elimination entries (inter-company adjustments) which need to be entered into the consolidated statements, in respect of the above journal entries.

These elimination adjustments are automated via the initial journal entry (top journal) and are automatically applied to consolidated statements run from SoftLedger.

Consolidated reporting:

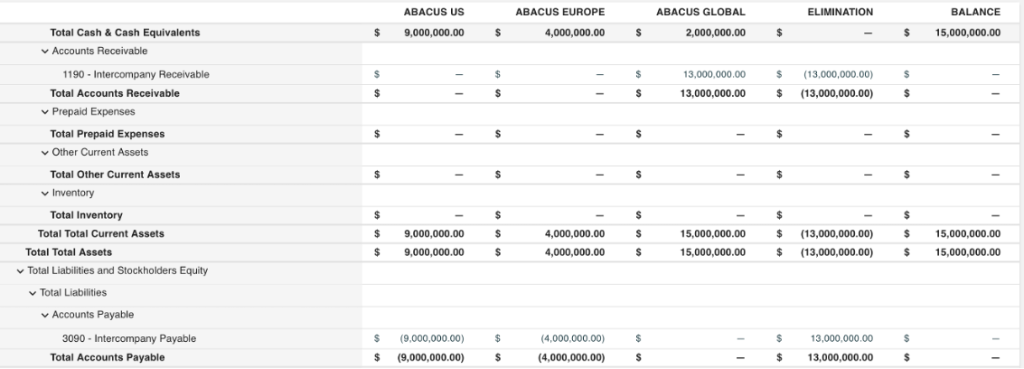

At the end of February 2023, a consolidated balance sheet is run from SoftLedger:

The balance sheet has been run at the ultimate parent level (Abacus Global), and therefore all group companies are shown within the statement.

The “eliminations” column shows the total value of intercompany adjustments for the period. In the total adjustments for Accounts Receivable and Accounts Payable, the journals described above can be seen by clicking the eliminations figure on the face of the report:

- Accounts Receivable adjustments:

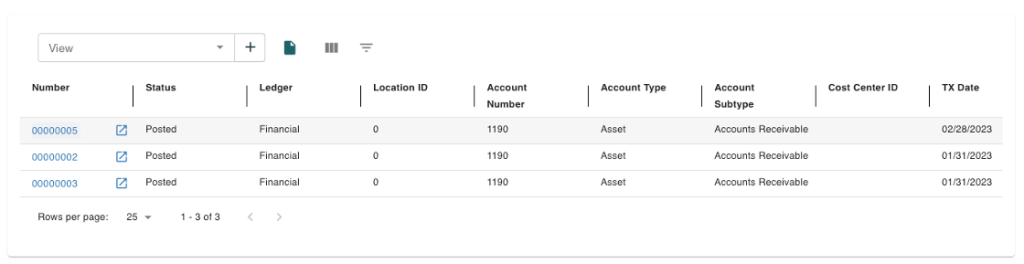

On clicking into the $13m accounts receivable elimination figure, the screen below is shown – it shows 3 journal entries which make up the total $13m adjustment.

The journal from our example is number 5 – so we can select it via a click. After doing so, we are presented with the elimination entries as below (which come directly from the journal above)

Note – the same procedure could be followed to drill into the Accounts Payable elimination adjustments.

Problem: Excessive time spent reformatting data for reporting

Being able to provide business insights via data analysis is often very time consuming.

Such a situation can often lead to frustration with the finance department from those in the business, since what seems like a simple request is often difficult to obtain within a given time frame.

This mismatch between expectations and ability to deliver, is frequently driven by inflexibility of the accounting software used.

To achieve such requests, tasks like below might be conducted by the finance team:

- Manual download and cross referencing of different data sets (e.g. through excel formulas, pivot tables etc) to produce a given report – each element being finely balanced within a given process

- Ad hoc manual processes to analyse and categorise different line items (these activities can be particularly prevalent for queries around income and expenditure items)

Many finance functions find themselves in the vicious cycle of over allocating labor resource to such activities, unknowingly accepting inefficient ways of working.

An example of how SoftLedger resolves this common problem

SoftLedger is a multidimensional platform.

This allows new customizable dimensions (data entry fields) to be set up within the system at a transactional level.

In turn, financial reports, and transactional level reports, can be run with these custom dimensions set as a criteria.

An example:

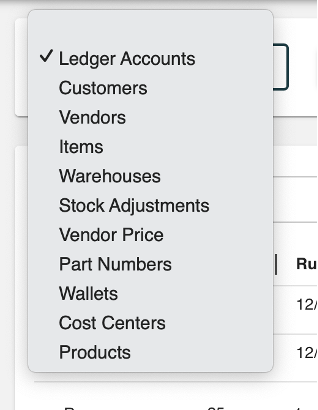

Abacus Global had following standard dimensions ready for use within SoftLedger when they transitioned to the system.

Key to understanding business performance for Abacus Global is the ability to run the Profit & Loss at a product level.

Abacus Global only has 5 different products, so an under or over performance in any product has a large impact.

Abacus Global has previously defined specific products as additional sub dimensions with the “Product” dimension.

The sub product dimensions set within the system (via a simple CSV upload) are as below:

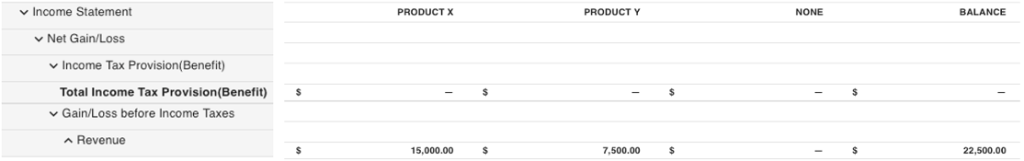

Running a Profit and Loss from SoftLedger with a product split

By using SoftLedger’s fully integrated, real-time reporting functionality, Abacus Global can run a profit and loss showing the performance at a product level.

The screenshot below shows the criteria Abacus Global has selected to run a product level P&L – for the year ending December 2023.

Note – there is full flexibility as to which products to include/exclude from the report. In this case, only products “X” and “Y” have been selected.

The image below shows an extract of the profit and loss run for the year ending December 2023 (down to the revenue line only). Products X and Y only are visible – following the criteria selection above.

If Abacus Global had wanted to run the P&L by a different variant e.g. by customer, location, or vendor, then that would have also been possible via the dimensions settings in the system.

Above are just a couple of examples of how SoftLedger resolves common accounting software growing pains.

If you would like to learn more, then please click here to book an introductory meeting.

This article was produced by Mark O’Hanrahan, Managing Director of North Hill Chartered Accountants, UK.