Many real estate investors use small business accounting software, but it’s not built to accommodate multi-entity businesses. Here are a few problems that typically arise:

- Creating (and paying for) an individual account for each entity within the parent company

- Manual multi-entity consolidation typically leads to a delayed financial close

- The team never has access to up-to-date, real-time data

As a result, most real estate investors don’t know how they did in early January until they finally close the January books in late February. This means executives are making critical decisions on inaccurate data, so the company might miss key growth opportunities.

To solve this problem, there are now modern accounting software options that:

- Automatically consolidate multiple entities

- Provide real-time data without the month-long delay

- Offer a simple and affordable price for exactly what you need

To give you a head start, we’ve compiled a list of the best accounting software for real estate investors. We’ll introduce you to a handful of the best accounting software solutions for real estate investors, including our own solution, SoftLedger.

- Best for companies of 2,000 plus employees – SoftLedger

- Best for single entity businesses – QuickBooks

- Best for solopreneurs – Xero

- Best for companies that need more flexibility – Flexi

- Best for companies of 2,000 plus employees – Netsuite

QuickBooks – Best For Single Entity Businesses

QuickBooks is a household accounting name as it’s a relatively easy software for small business owners to learn and use. So if you just need a simple solution that will track expenses, send invoices, and provide assistance during tax time, QuickBooks might be a good solution.

However, ease of use comes at the cost of scalability. Real estate investors with rapidly expanding businesses quickly outgrow this accounting software solution. This is due to its inability to enable accountants to integrate multiple entities into one account. So you’ll be able to track most of your data in QuickBooks, but multi-entities will still be using spreadsheets for a lot of their accounting processes.

QuickBooks also offers a mobile app that’s compatible with iOS and Android for those that want to track their accounting on the go.

Pricing

QuickBooks pricing starts at $25 per month with the Essentials, Plus, and Advanced plans priced at $50, $80, and $180 per month. If you have multiple users, you’ll probably need at least the Essentials plan. Additionally, if you’re doing any multi-entity or multi-currency consolidation, you’ll probably have to purchase add-ons.

Xero – Best For Solopreneurs

Xero is a great accounting solution for solopreneurs with no accounting experience that want a super easy-to-use tool that just works. It offers all of the key accounting features like a balance sheet, income statement, online invoicing, bank account integrations, cash flow, and customizable reports.

Given that it’s designed for beginners and solopreneurs, it lacks the advanced accounting functionalities that larger multi-entity companies need. It’s also not very flexible – so you can use the apps in the Xero App Store, but you can’t build any custom integrations.

So if you just need a simple solution that makes it easy to track income and expenses, send invoices, and create simple financial reports, Xero might be a great solution. To get started, you can just select one of their pre-made templates and adapt it to your business.

Its customer support is also highly rated, so if you run into trouble, you can always ask your questions.

Pricing

Xero’s monthly fee starts at $12 per month. It offers all the essentials like billing, invoicing, bank transaction reconciliation, and bookkeeping. Its Growth and Established plans are $34 and $65 respectively.

Flexi – Best For Companies That Need More Flexibility

Flexi is designed for larger companies that want a more modern accounting solution that streamlines traditionally laborious processes. Specifically, Flexi offers:

- General Ledger Software

- Accounts Payable

- Accounts Receivable

- Purchasing Software

- Fixed Asset Management

- Workflow Automation

- Financial Reporting

So whether you’re looking for a solution that makes it easier to consolidate multiple entities or automate tedious processes, Flexi might be a good option.

It’s based in the United States and offers a customer support phone number and email. Its customer support is also fairly well rated in case you run into problems.

Pricing

Flexi doesn’t offer any pricing information.

Netsuite – Best For Companies of 2,000 Plus Employees

Launched in 1999, NetSuite is a legacy tool that many older corporate businesses use for their accounting needs. It offers robust automation and reporting for large enterprise companies that have highly advanced needs.

Netsuite requires significant investment to set up and manage as you’ll need a programmer with proprietary programming knowledge of the software to build integrations. The system is also quite complex and often takes a few weeks for employees to get the hang of.

Given that Netsuite has been around for some time, there are a host of add-ons that you can use to customize the solution to work for you (such as multi-entity and multi-currency consolidation tools).

Pricing

Netsuite doesn’t offer any pricing information on its website. That being said, various reviews across the internet suggest that it starts at over $1,000. That also doesn’t include all of the setup and training costs.

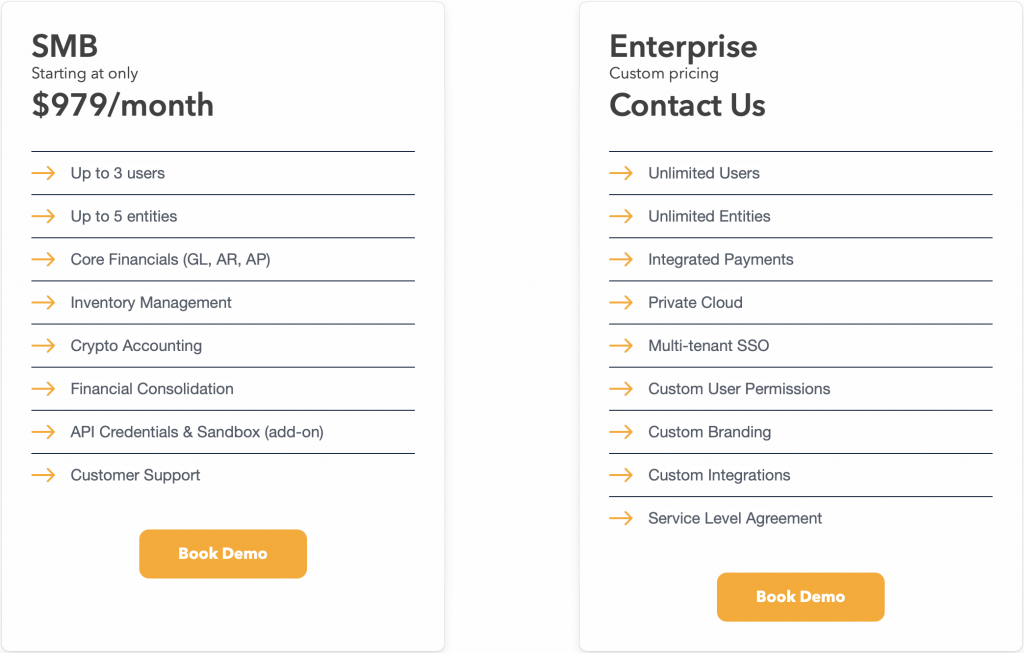

SoftLedger – Best For Multi-Entity Consolidation and Real-Time Data

SoftLedger is a customizable accounting platform designed specifically for multi-entity companies. Rather than creating multiple accounts for each entity, the general ledger always provides a consolidated view of real-time data.

This empowers real estate investors to always operate with up-to-date data. Additionally, its intuitive interface makes it easy for the team to learn.

Here’s a detailed look at a few key features people love about SoftLedger.

Automatic Multi-Entity Consolidation

Multi-entity consolidation in traditional SMB accounting solutions is cumbersome. The accounting team has to set up an account for each and every entity. They would then need to manually consolidate the entities at the end of the month. Unfortunately, this means that the company never has a single consolidated view of the entire company’s performance until the end of the month.

In addition, manually consolidating data (which involves downloading a CSV file from each account and compiling the information into a single spreadsheet) is time-consuming and exposes the data to manual error.

If you do make an error consolidating the data, you’ll have to go back into all impacted accounts and adjust them accordingly.

With SoftLedger, you’ll never have to manually pull together. This is because the general ledger seamlessly integrates all data from your entities automatically.

For example, if an expense is entered into Entity A, it will immediately be reflected in the general ledger. This saves your team hours each month and means you can always close the month in a day or two.

It’s also worth noting that SoftLedger performs all prerequisites necessary to consolidate the data. For example, if you’re recording an entry for an entity in a foreign currency, the currency needs to be consolidated before the data can be consolidated. So SoftLedger automatically consolidates the foreign currency and then executes the multi-entity consolidation – in a matter of seconds.

This is critical because while some accounting systems offer multi-entity add-ons, those add-on tools only work once the data has been prepared to be consolidated. So instead, SoftLedger takes care of all of those processes for you.

Real-Time Data

Most accounting software requires accountants to update data across the system manually. For example, if you enter an online payment into the accounts receivables for one entity, you’d have to manually adjust all of the other impacted accounts.

Manually adjusting accounts puts the data at risk of error as it’s easy to accidentally miscalculate something or forget to make an adjustment.

In addition, manually updating and consolidating data extends the time it takes to close the books. With these delays, real estate investors don’t see data from early January until the very end of February. This means executives don’t have reliable data when making financial decisions.

SoftLedger solves this by offering real-time data.

Here’s how it works.

The instant an entry is made to a single entity’s account, the system updates all impacted accounts to reflect that transaction. As SoftLedger’s accounting system is seamlessly integrated, this also means that the general ledger (which shows a consolidated view of the entire parent company) is also adjusted.

Tracking live gains, losses, and asset balances tells you how to immediately cut losses and better allocate capital to generate higher returns.

REST API for Integration

Legacy solutions (like Netsuite) make integrations a daunting challenge because it’s very difficult to integrate with their API. Often, the team has to hire a third-party consultant with expertise in Netsuite’s proprietary programming language to perform the integration, and the process can take months.

So we built SoftLedger to be highly customizable and flexible so that anyone can create integrations in less than a day. Specifically, SoftLedger has a REST API. This means any developer can quickly build the integration with little to no hassle (ask them for more on why this is so much easier).

Choosing The Best Accounting Software For Real Estate Investors

There are plenty of accounting software solutions for real estate investors available, though the industry has been slow to offer modern, streamlined solutions. While many of the newer small business accounting software solutions are easier to use, they also strip the flexibility and advanced capabilities that multi-entity companies need.

We built SoftLedger specifically to solve this problem.

To recap, SoftLedger is different for a few key reasons:

- Automatic, multi-entity consolidation: You never have to purchase an add-on as the general ledger always reflects a consolidated view (while still enabling you to drill down and view any individual entity).

- Real-time data: The general ledger automatically updates itself the instant one transaction hits any particular entity’s account. This means you always have up-to-date data throughout the month.

- A REST API that makes integrations a breeze – Rather than relying on the apps available in an SMB accounting software’s app store, you can easily build your own integrations and customize them to your needs.

If you want to see for yourself if SoftLedger is the best solution for your needs, book a demo today.