Does your company frequently handle foreign currencies? If so, you are aware that foreign exchange rate fluctuations can significantly impact your financial reporting.

Specifically, if a transaction occurs on the 5th of the month, the foreign exchange rate might be different when you close the books on the 30th.

A Cumulative Translation Adjustment (CTA) is required in order to distinguish between gains and losses resulting from operations, versus those that have resulted from fluctuations in foreign currency.

Below, we’ll discuss what a CTA is, why they’re important, and finally, how to record them on the balance sheet.

What Is Cumulative Translation Adjustment (CTA) In Accounting?

The Cumulative Translation Adjustment (CTA) is a line item in the balance sheet that shows the gains and losses created by exchange rate fluctuations. CTA entries are important because of the fluctuations that take place with exchange rates over time. The US GAAP, Financial Accounting Standards Board (FASB) Statement 52, and IFRS, per International Accounting Standards (IAS) 21, all require CTA entries. This is so that investors can accurately assess gains and losses from business operations versus fluctuations in exchange rates.

In this post, we’ll discuss why CTA entries are important, how to record them on the balance sheet and how to automate the entire process.

Example of A Cumulative Translation Adjustment (CTA)

Let’s walk through an example to visualize how cumulative translation adjustment (CTA) works.

Company A is from the United States, and the dollar is its functional currency. However, Company A has a subsidiary in Singapore that reports in SGD. The Singapore subsidiary sold widgets for 100,000 SGD on 12/15/2021.

At the time of the transaction, the exchange rate from SGD to USD was $.73213, but at the time the retained earnings entry was booked on 1/1/2022 the rate was $.74148. Instead of a retained earnings balance of $73,213, the balance is $74,148 as a result of revaluation at the end of the period, creating a variance of $935.

The variance is resolved, and the consolidated balance sheet is balanced through the Cumulative Translation Adjustment. A debit entry is booked to Accumulated Other Comprehensive Income on Company A’s books for $935, with a credit booked to Other Comprehensive Income. This entry offsets the initial variance created on the Singapore entity’s books, therefore resulting in a balanced consolidated balance sheet.

Why Are Cumulative Translation Adjustments Important?

Cumulative translation adjustments are important because foreign currency fluctuation can falsely inflate the business’s profits or losses.

In the example above, you can see that the company would have inaccurately recorded its net income if the CTA of $935 was not recorded.

How to Calculate A Cumulative Translation Adjustment?

To calculate the cumulative translation adjustment (CTA) entry, take the difference between the transaction amount in the foreign currency multiplied by the exchange rate on the date the transaction occurred and the transaction amount in the foreign currency multiplied by the exchange rate on the date the transaction was entered.

Here’s a visual representation of the cumulative translation adjustment formula:

To help you better visualize this, here’s an example of this in action:

- A U.S. based company with a functional currency of US dollar purchases a factory in England for 500,000 euros.

- The exchange rate of one euro is $0.96 on the date the transaction occurred

- The exchange rate of one euro is $0.98 on the date the transaction is recorded

In this case, here’s what the formula would look like:

In this case, you would debit accumulated other comprehensive income and credit other comprehensive income for $935.

Cumulative Translation Adjustment Journal Entry

To help you accurately enter a CTA journal entry, here’s a step-by-step overview of how to do so in SoftLedger.

Step 1: System Setup

Here, we set up two locations/legal entities. The global entity operates in USD, and SGD is a subsidiary operating in SGD.

Step 2: Establish Accounting Periods

For this example, we’ll assume that the business’s fiscal year is the same as the calendar year. If that’s the case, you don’t have to do anything here.

Step 3: Accounts Setup

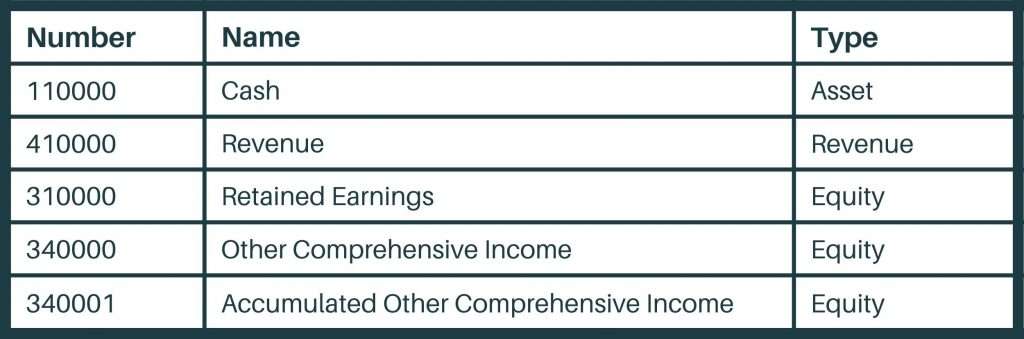

For this example, we’ll book a journal entry (see Step 5 below) for the SGD location so that you can see how this impacts the consolidated balance sheet. Here are some of the accounts we’ll be using. You’ll need to create an account for both Other Comprehensive Income and Accumulated Other Comprehensive Income if you don’t have those already.

Step 4: Set Up System Account Default Settings

Now you can navigate to Settings and under “Accounts” set the default settings. Select your desired accounts in the “Financial Close” section to be used in the automatic journal entry calculations.

Step 5: Update The Balance Sheet

In this example, we’ll update our balance sheet as noted above.

Once you’ve completed that step, you’ll see the unconsolidated balance sheet:

Step 6: Close The Year

As you can see, the SGD subsidiary is showing $100,000 in total assets, and the balancing amount is equal to retained earnings.

Now, when we switch over to the consolidated view, you’ll see that the SGD$100,000 in total assets is automatically converted to USD$73,212.90 (assuming that we’re using 0.732129, which was the exchange rate on 12/15/21 – the transaction date of the journal entry).

Note that SoftLedger automatically pulled this exchange rate and executed the calculation. As a result, you never have to perform a single calculation yourself.

Now switch over to the USD tab, and you’ll see the automatically consolidated view:

When you first look at the first SGD and Global locations, they don’t balance.

Specifically, the total assets are recorded as $73,212.90, and the total retained earnings are recorded as $74,148.20.

This is because the exchange rate from the initial date the transaction was recorded (12/15/21) was different from the exchange rate on the date the books closed (12/31/21). Therefore, there is a USD$935.30 discrepancy.

To solve this imbalance at the consolidated level, SoftLedger automatically books the CTA entry at the parent level under Accumulated Other Comprehensive Income.

On the other side, it is booked as the Other Comprehensive Income, which doesn’t exist on the balance sheet.

This ultimately gives you a balanced consolidated number without performing a single manual calculation.

Finally, to close the year, all you have to do is navigate to the admin page and go to “Accounts Periods”, and close out 2021 FY. This process will book the retained earnings and CTA entry.

Software to Automate the Cumulative Translation Adjustment Process

If your company has foreign subsidiaries or frequently processes foreign currency transactions, you know that it can be complicated to accurately account for the impact of foreign exchange rate fluctuations.

It can be a manual process that is tedious and time-consuming for accountants. Additionally, it exposes your financial data to human error.

To solve this problem, we built SoftLedger to automate the entire foreign exchange process.

To see for yourself how SoftLedger can improve your team’s efficiency, schedule a demo today!