The month-end close process is necessary for tax preparation, internal auditing, and tracking the company’s overall financial health. However, it is a time-consuming and laborious process that can take days for larger companies to complete.

Fortunately, having defined systems and processes can significantly reduce the time investment required to close the books.

So in this post, we’ll discuss what the month-end close is, walk through a nine-step checklist, and provide automation solutions.

What Is the Month-End Close Process?

The month-end close is the process of recording, reconciling, and reviewing all business transactions, as well as preparing monthly financial statements (if your company needs them). It’s also referred to as “closing the books”.

The month-end close is also a fiscal reporting requirement for some companies following certain accounting standards.

However, The details of the month-end close process depend on the size of a company and the number of financial transactions completed. Nonetheless, here are the typical steps accountants and financial teams take during a month-end close:

- Ensure all customer and vendor invoices and bills are entered into the accounting system.

- Reconcile all bank accounts and inventory assets in the accounting system, including reconciling intercompany bank transfers.

- Produce monthly financial statements, including but not limited to a profit and loss statement, a balance sheet, and a cash flow statement.

- Carefully review the bank and credit account statements.

- Close the period modules in the accounting system.

Why Is the Month-End Close Process Important?

Businesses must be aware of their current financial status in order to make appropriate operational and investment decisions.

For example, the financial statements produced at the month-end close can help businesses identify the most profitable and costly products, customers, or locations. This can help executives decide which parts of the business should be kept, changed, or potentially sold.

In addition, companies may be required by law or under certain accounting standards to produce monthly financial statements.

Most public companies follow a standardized set of accounting principles, and to make global fiscal reporting more consistent, transparent, and cross-functional, accounting standards like International Financial Reporting Standards (IFRS) were created.

Accounting standards like IFRS keep the financial statements of public companies around the world objective and accountable.

Closing the Month Manually vs. Automatically

Accounting teams can choose to close the month manually with a combination of small business accounting software (e.g., QuickBooks, Xero, etc.) and spreadsheets, or they can use automation that executes the process for them.

While small businesses can usually manually close the month, larger companies with more complex accounting processes (e.g., multiple entities, foreign currencies, etc.) usually require automation.

Otherwise, the month-end close process can drag on for days.

So below, we’ll show you how to manually close the month and introduce you to accounting software that automates the entire process for you.

Automating the Month-End Close Process

Below is a brief overview of the month-end close process in SoftLedger, or you can see a more detailed walkthrough of the month-end close process.

Before jumping into how SoftLedger automates the month-end close process, it’s worth noting that a key reason SoftLedger can automate the entire month-end close process is that it operates in real-time data.

So the instant an entry is booked in the system, it automatically adjusts impacted accounts and the general ledger to reflect the transaction.

In addition, SoftLedger is designed to automatically execute various prerequisite processes required to adjust impacted accounts. For example, if you’re consolidating multiple entities, SoftLedger automatically executes intercompany eliminations for you. Similarly, if you have crypto transactions, SoftLedger automatically calculates the cost basis and unrealized and realized gains/losses.

As a result, it can automatically create journal entries for each transaction and update the general ledger accounting software to always reflect the company’s current financial status.

Now that you understand how SoftLedger ensures you always have access to up-to-date data, here’s how it automates the month-end close process.

Step 1: Create Accounting Years

First, add the necessary fiscal accounting years to cover your transactions.

Step 2: Add the Necessary Ledger Accounts for the Close

Before closing any periods, set the following system-level accounts:

- Accumulated Other Comprehensive Income

- Other Comprehensive Income Account

- Retained Earnings Account

- Foreign Currency Gain/Loss Account

As you can see below, this only takes a few clicks inside SoftLedger.

Step 3: Confirm All Activity Has Been Added and Posted

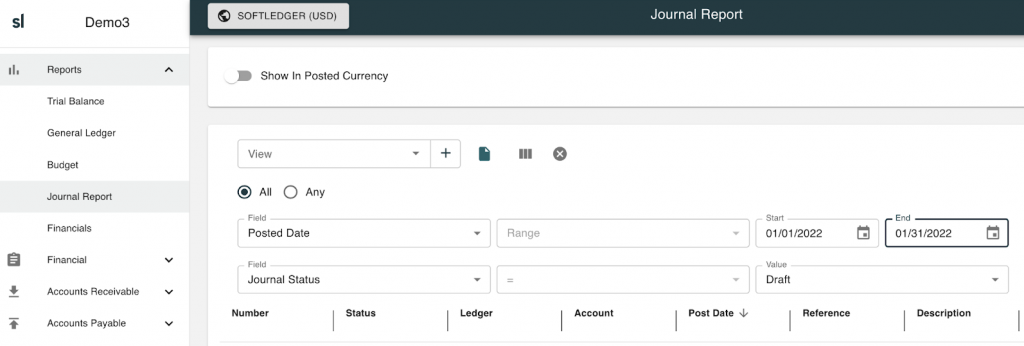

Now, check that all activity has been created and posted. You can do this by looking at the Journal report and filtering the posted date for the month you’re about to close. You can also check the journal statuses to see if any are still marked as drafts.

Step 4: Review Reports to Confirm Balances Are as Expected

Now, confirm that all of the balances are as expected. Here are a few common reports worth checking, though the exact accounts you should review depend on your company’s activity:

- Balance Sheet

- Income Statement

- Trial Balance

- General Ledger Summary

- Aging Reports (AP & AR)

- Reconcile

- Stock page

Step 5: Close the Tasks in the Accounting Periods Module

Now all that’s left is closing the tasks in the accounting period module.

That’s it! From there, SoftLedger closes the books for you.

As you can see, using automation software helps the accounting department save days completing the month-end close process in endless spreadsheets.

In addition, using accounting software with real-time data makes it easier for the company to track its financial health throughout the month so that there are no surprises when the closing date comes.

To see for yourself how SoftLedger can help you improve the month-end close process, schedule a demo or try the platform today!

Nevertheless, if you’d prefer to execute the process manually, here’s a step-by-step checklist.

How to Execute the Month-End Close Process (9 Step Checklist)

Every company certainly has a slightly different month-end close checklist, as the process varies depending on its size, structure, and processes.

For example, an eCommerce company tracking inventory will have a slightly different month-end checklist from a SaaS company with purely digital products.

Here’s a 9 step checklist you can use to streamline your month-end close:

Step 1: Record Income and Expenses

Start by recording all the income your business earned throughout the month. This includes sales, debt repayments, investment income, and other forms of income.

After that, enter all customer invoices for the month into your accounting system and link to customer payments. This will show you which clients paid on time, late, and those who never paid. Double-check this to ensure you’ve invoiced all your customers accurately, and send out any remaining invoices.

If you’re not recording your expenses in real-time, attempt to record them weekly to minimize your workload at the end of the month.

Here are some expenses you should record:

- Supplier payments

- Insurances

- Utility bills

- Business travel expenses

- Payroll

- Business loan interest

Check you’ve posted debit and credit entries accurately for all the transactions. Next, review the posted journal entries in your general ledger. This is the master ledger with all your business transaction data.

Step 2: Update Accounts Receivable and Accounts Payable

Identify any outstanding bills and payments to close out the AP and AR. You also want to take any exceptions into account, like discounts.

Here are some specific steps to follow in Accounts Receivable:

- Create an aged debtors report. This report divides your unpaid invoices out by time period so you can see the amounts you are due to be paid within 30 days, 60 days, etc. You can create one of these reports easily with SoftLedger.

- Follow up with customers who’ve exceeded their credit period.

- Account for discounts.

- Recognize bad debt.

Next, review your Accounts Payable to check you’re making invoice payments on time. Here are a few steps to follow:

- Create an aged creditors report.

- Note overdue invoices for immediate payment.

- Look for any mistakes, including duplicate invoices.

- Avoid duplicate payments.

Step 3: Prepare Account Reconciliations

Account reconciliation involves matching and verifying every business transaction with that of the corresponding bank, creditor, vendor, or business. In other words, it’s a way to double-check your bookkeeping and will help you spot mistakes in your financial data.

A bank reconciliation statement summarizes banking and business activity by reconciling a business’s bank account with its financial records. Bank reconciliation statements confirm that payments are processed, and cash collections were deposited into a bank account.

Here are the typical accounts to reconcile:

- Checking and savings accounts

- Digital payment and money transfer accounts like PayPal and Wise

- Loan and credit card accounts

Follow these steps in your bank reconciliation process:

- Check the ending balances, deposits, and withdrawals of your bank statements against your cash book.

- Identify discrepancies. These discrepancies could be uncleared checks, mistakes in internal records, duplicate charges, and bank charges. Keep an eye out for any suspicious transactions.

- Make adjusting journal entries.

- Create a record of your bank reconciliation for documentation purposes.

Step 4: Review Inventory

Follow these steps during the month-end close process:

- Take an inventory count.

- Review and update the inventory numbers in your books.

- Review your inventory management process. This is the level of inventory you hold, how often you order, and the price you pay.

- Review your storage methods.

Step 5: Review Fixed Assets

Here are a few steps for your fixed asset review:

- Record all purchases, improvements, and sales of fixed assets

- Account for depreciation and amortization expenses

- Record other expenses, such as repairs and maintenance

- Review the condition of your fixed assets

Larger pieces of machinery, technology, and other assets are sometimes translated to cash in your ledger. This is due to the depreciation and amortization process, meaning the value of these assets falls over time. Since assets are expensive, you’re allowed to spread the cost of depreciation in the form of expenses as the years go by.

Recording any change in value to these assets (including repairs or amortization) is important to keep your books steady and avoid sudden jumps in profit or loss.

Step 6: Reconcile Accrued and Prepaid Accounts

Accrued accounts include:

- Accrued revenue: revenue incurred but no cash received (yet)

- Accrued expenses (accrued liabilities): expenses incurred but not paid

Your accounts payable only captures short-term payables to creditors. Reconciling accrued expenses will help you stay on top of all invoice payments and dues within a year.

Prepaid expenses are what you’ve paid ahead of time, and they’re an asset you’ll recognize as expenses in different accounting periods as you consume the goods or services you’ve paid for.

At the end of the month:

- Adjust accrued and prepaid expense accounts to reflect any income received and expenses paid during the month

- Double-check your prepaid accounts with your expense accounts to avoid duplicate payments

Make sure you pay any accrued liabilities when they’re due. This way, you won’t damage your business’s credit reputation and will continue to have access to supplier credit.

Step 7: Prepare Financial Statements

Once the accounts have been reviewed and reconciled, the next step is to prepare the following financial statements:

- Income statement/profit and loss statement

- Balance sheet

- Cash flow statement

Step 8: Review Your Financial Information

To avoid mistakes, review your financial information again before closing the books. Larger companies that have internal controls, like the segregation of duties, may assign a senior accountant to review the financial information again before closing the books.

Once the books are closed for the month, you can’t go back and make further adjustments. So ensure that you’re diligent during the review process.

Step 9: Plan Ahead

It’s tempting to avoid reopening your books until the next month-end, but staying up to date and continuously executing these processes throughout the month will help you stay on top of your books.

You can also look at the month-end close process and improve it for next time. Here are some questions to ask about your previous month’s performance:

- What were the successes and failures?

- Are there any issues to address immediately? For example, maybe you’re low on cash and risk defaulting on upcoming dues.

- What business and month-end processes should you change?

- How is the business tracking against your long-term goals? Are you moving in the right direction?

- Can you foresee long-term business challenges?

- Should you implement internal controls to avoid future accounting issues?

Once completed, carefully review these statements and make changes based on additional data, calculation errors, or budget variances. If you operate off a financial plan, compare the results with your forecast and adjust the plan if you aren’t on track.

Finally, close the period in your financial system and distribute the financial statements to the intended audience, like senior management, shareholders, or your tax accountant.

Final Thoughts

While it’s possible to go through a month-end close manually, SoftLedger can save your accounting team hours (if not days!) by automating the process.

In conclusion, by closing the books faster, you can redirect valuable human resources to higher-impact tasks and ensure executives always have access to more accurate data so they can make better decisions for the company.

To see for yourself if SoftLedger is the right platform for you, book a demo today!