Back in the early 1980s, we saw the first general-purpose accounting system. Prior to this, there were specific-purpose systems for certain industries and business processes, but then accounting departments needed to do a lot of manual/tedious work to get all that data into a format that was usable for management, investors, regulators, and other stakeholders. Systems like Great Plains (now called Microsoft Dynamics GP) allowed one system to serve a variety of industries. This was a huge innovation and really has become the basis for how all businesses record their accounting and financial reporting.

Then in the late ’90s, another big innovation came along. Cloud computing made it so that accounting users could be geographically distributed, companies no longer had to maintain servers, and subscription-based business models were able to take off. What didn’t happen, was a fundamental re-thinking of how cloud computing could change the architecture of an accounting system.

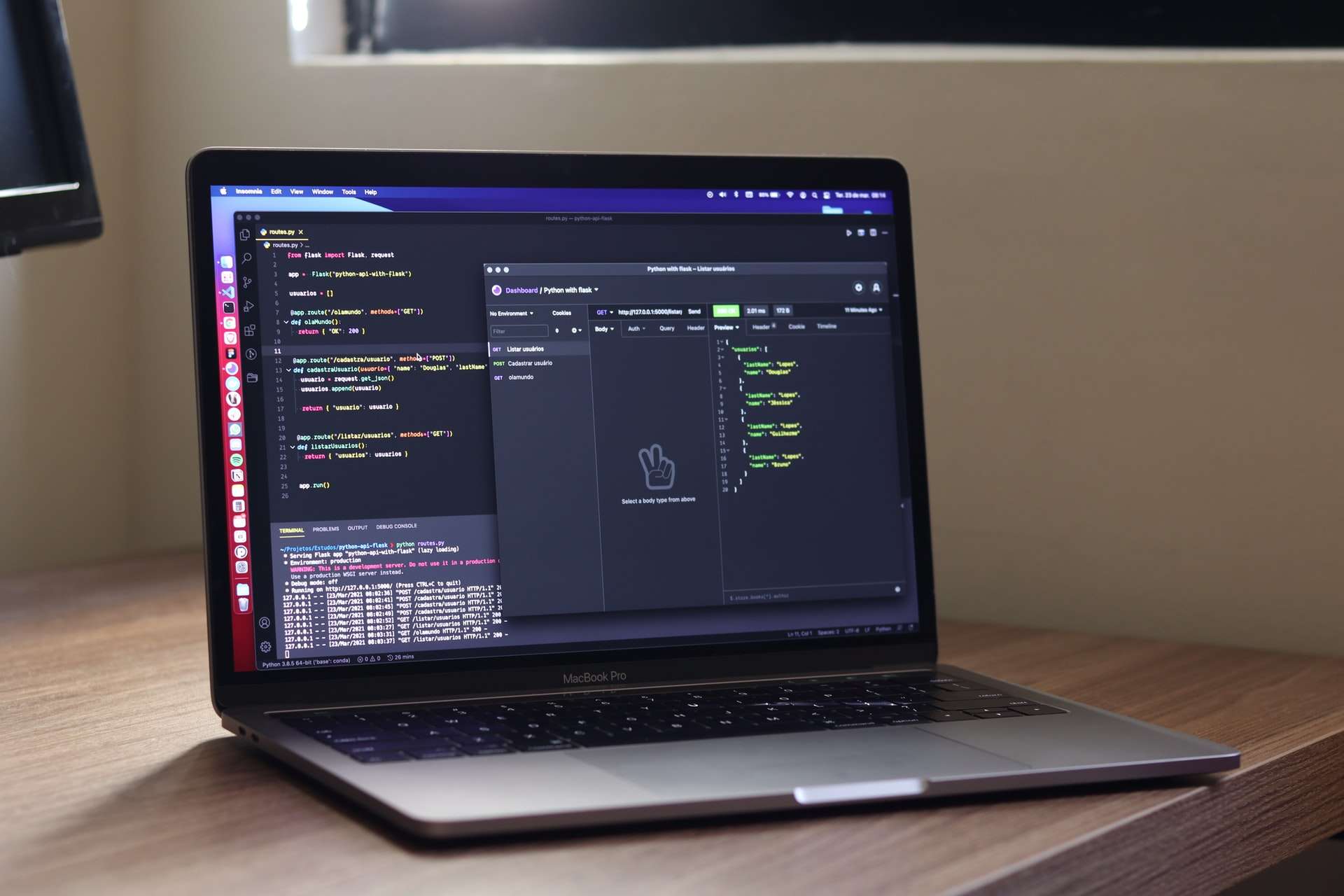

Fast forward to today and the world looks a lot different. There are many cloud applications that impact a company’s financial position and performance. But accounting systems remain siloed. A lot has happened in the past 20 years and accounting systems have not changed. One thing to help your accounting processes is the use of REST APIs.

Using modern accounting REST APIs can help automate accounting and reporting for companies.