Ark Financial Moved from Manual Bottlenecks to Confident, Real-Time Decision Making

About Ark Financial

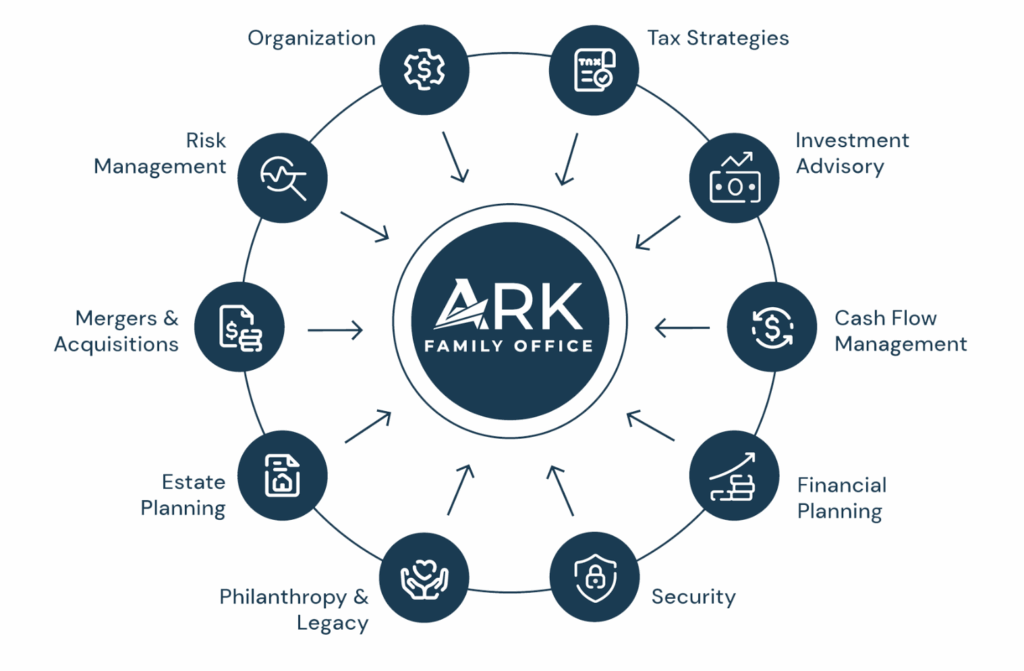

Ark Financial delivers personalized wealth management and family office services to entrepreneurs and high-net-worth professionals. They specialize in building tax-efficient structures, estate planning, and holistic financial strategies through their proprietary “Family Office Operating System” — a framework refined over 12 years of working closely with sophisticated clients.

The Problem

In a high-trust industry like wealth management, the stakes for precision, transparency, and speed are high. Before implementing SoftLedger, Ark Financial faced several operational challenges that made their family office accounting more difficult:

- Multi-entity consolidation difficulties: Manual processes across multiple entities led to reporting delays and reconciliation challenges. QuickBooks’s limitations complicated closing activities.

- Lack of real-time visibility: Financial data was largely shared through static PDFs, limiting collaboration, transparency, and timely decision-making.

- Manual intercompany transactions: Without automated eliminations, errors in intercompany accounting impacted tax filings and financial statements.

- Multiple accounting systems: Having to switch between multiple disconnected accounting systems created further inefficiencies and risk of inaccuracies.

The SoftLedger Solution

Ark Financial selected SoftLedger to modernize their financial operations and support their growing multi-entity structure. mThe implementation delivered both immediate improvements and long-term scalability—without the complexity and overhead of traditional ERP systems.

- Automated Multi-Entity Consolidation: SoftLedger centralized Ark’s accounting across all entities, jurisdictions, and currencies—eliminating manual processes and spreadsheet workarounds.

- Real-Time Reporting and Collaboration: Stakeholders can now log into the same system, view live financials, and collaborate directly—eliminating reliance on emailed PDFs or handwritten notes.

- Automated Intercompany Accounting: With built-in eliminations, intercompany transactions no longer introduce reconciliation errors or tax complications.

- Digital Asset Management: SoftLedger’s native support for digital assets made it easy to track, revalue, and report on crypto holdings within the same financial system.

- Transaction Date vs. Posted Date Logic: Addressed prior QuickBooks challenges around cash receipt application and historical accuracy, enabling cleaner closes and better audit trails.

- Flexible API and System Integrations: Ark seamlessly integrated SoftLedger with their CRM, payroll, and document workflows using the platform’s robust API.

Multi-Dimensional Reporting – A Key Upgrade from QuickBooks

A major differentiator for Ark Financial was SoftLedger’s Ledger Account by Dimension report, which allows for deep, flexible analysis far beyond what QuickBooks offers.

This enables Ark to generate reports such as:

- Expenses by department across multiple entities

- Revenue per customer across all jurisdictions

- Vendor-specific cost analysis by category

Rather than waiting weeks for consolidated, static reporting, Ark’s leadership can now drill down into live, structured reports filtered and grouped exactly how they need them.

SoftLedger’s multi-dimensional architecture transformed financial data from a backlog into a strategic asset, giving Ark Financial the visibility and structure needed to operate at a higher level.

Results

Since adopting SoftLedger, Ark Financial has experienced transformative improvements across key operational areas:

Faster Close Process

Time to close reduced by over 50%, significantly improving monthly and quarterly reporting cadence. Consolidation across multiple entities now occurs in real-time, not weeks.

Accuracy and Compliance

Automated intercompany and digital asset entries reduced material errors and audit risks. Manual intercompany entries eliminated, reducing the risk of material misstatements across entities.

Real-Time Visibility

Real-time access to consolidated reports for stakeholders, replacing static PDFs and manual annotations. Leadership now has real-time access to performance data across the entire family office structure.

Cost Savings and Team Efficiency

SoftLedger delivered a more cost-effective and scalable solution compared to large enterprise alternatives like Oracle NetSuite or Sage Intacct. Hours saved per month are reallocated to strategic planning, analysis, and client service delivery.

Improved Audit Readiness

Audit and due diligence processes streamlined, with cleaner financials and traceable entries.

More Customer Stories

Gaingels Enhances Investment Management Across Global Portfolios SoftLedger helped Gaingels manage its own explosive growth with a high-performing accounting system […]

Ecogy Energy Streamlines Multi-Entity Accounting See how Softledger played a pivotal role in facilitating the optimization of Ecogy Energy’s payables […]

SoftLedger & ApproveIt Automate G-20 Group’s Multi-Entity Financial Reporting G-20 Group, a Swiss-based asset management and advisory firm, enhanced its […]