Power Leverages Softledger to Create a Nimble Digital Banking Solution

Thanks to the prowess of SoftLedger’s cloud accounting platform, Power Financial Wellness successfully eliminated the arduous task of manual data entry, considerably reducing the risk of errors, while simultaneously delivering real-time reporting on multiple financial service offerings to a vast customer base.

About Power

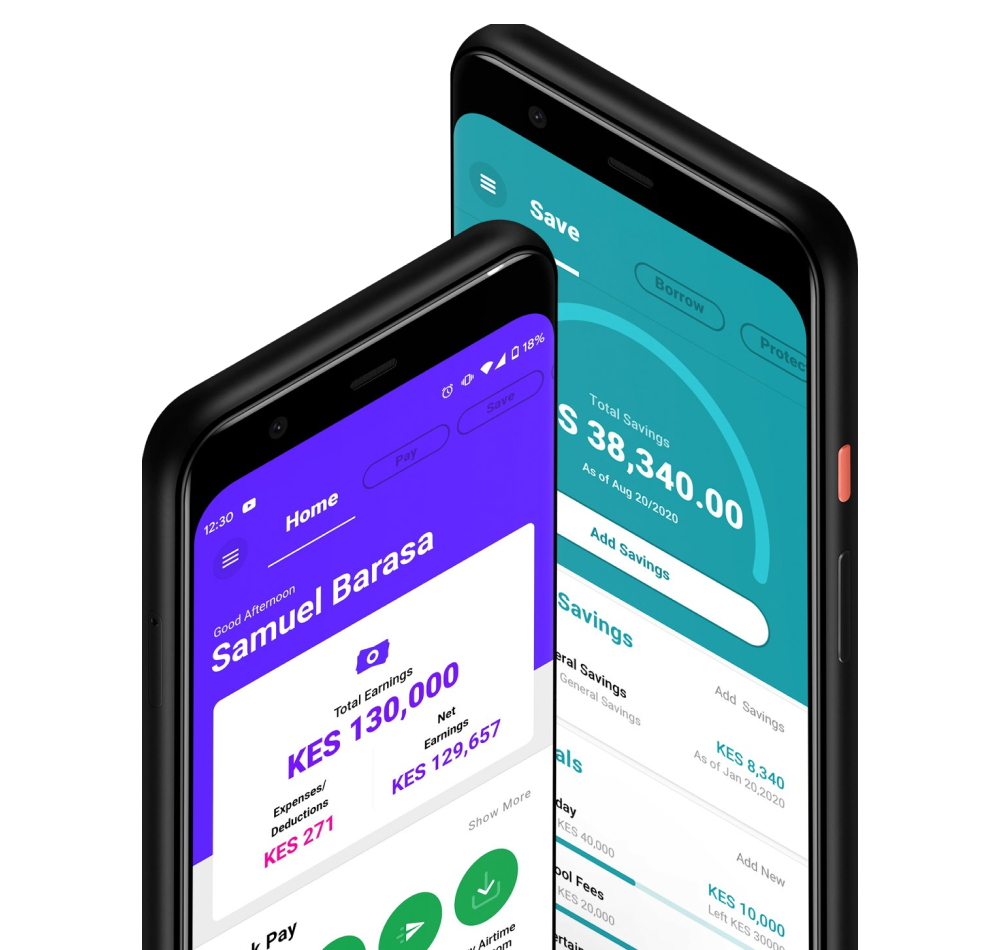

Power Financial Wellness is a FinTech company headquartered in Kenya. Their digital banking platform provides a comprehensive set of financial services to workers (particularly contractors, Uber drivers, and members of the growing gig economy) who need a “one-stop-shop” from which they can access and control their cash resources.

Through Power, companies can sign up and enable their workforce on the platform. Workers receive an app that gives them instant, up-to-the-minute access to their earnings. They are able to streamline savings and investments, borrow against projected future income, and digitize medical insurance. Power uses the data it gathers, in tandem with partner banks, to layer their products through the platform to the end-user.

Currently, the company is expanding across Eastern Africa, with an aim to become the preferred platform for gig workers to manage and improve their financial health across the continent.

The Problem

It is incredibly complex to provide real-time reporting on multiple financial service products to tens of thousands of customers. Because these customers are also located in multiple countries, using multiple currencies, there is a need for partnerships with local banks – adding another layer of complexity.

To solve this problem, Power needs to provide a full digital banking solution. An essential piece of this solution must include accounting for this high volume of complex transactions, as fast as possible. And given that speed is such a critical component of providing an effective solution for their customers, any accounting ledger must be integrated into their platform and enabled for reporting and accounting across multiple dimensions, cost centers, and partners.

Further, Power knew their ambitious expansion would also greatly increase the number of banking partners. In order to provide comprehensive financial statements, they needed a comprehensive, nimble, multi-entity solution that could easily segregate and consolidate transactions on a per-country and per-partner basis.

The SoftLedger Solution

Despite the complexity inherent in Power’s business, it only took a few weeks to get SoftLedger up and running for their team.

Thanks to SoftLedger’s versatility, Power was able to completely eliminate the need for manual data entry, reducing the risk of mistakes and saving countless man-hours. In fact, what used to take three to four hours, now can be done in just a few seconds.

Explore more Customer Stories

Ark Financial Moved from Manual Bottlenecks to Confident, Real-Time Decision Making Ark Financial reduced close time from weeks to days, […]

Gaingels Enhances Investment Management Across Global Portfolios SoftLedger helped Gaingels manage its own explosive growth with a high-performing accounting system […]

Ecogy Energy Streamlines Multi-Entity Accounting See how Softledger played a pivotal role in facilitating the optimization of Ecogy Energy’s payables […]