Case Studies

Explore our resources by topic to find the insights and information most relevant to your needs

Ark Financial Moved from Manual Bottlenecks to Confident, Real-Time Decision Making Ark Financial reduced close time from weeks to days, […]

Gaingels Enhances Investment Management Across Global Portfolios SoftLedger helped Gaingels manage its own explosive growth with a high-performing accounting system […]

Ecogy Energy Streamlines Multi-Entity Accounting See how Softledger played a pivotal role in facilitating the optimization of Ecogy Energy’s payables […]

SoftLedger & ApproveIt Automate G-20 Group’s Multi-Entity Financial Reporting G-20 Group, a Swiss-based asset management and advisory firm, enhanced its […]

EasyGo Revolutionizes Online Gaming with SoftLedger’s Accounting Solution EasyGo, a leader in the online gaming sector supporting brands like Stake.com […]

Anti Capital Tackles Complex Crypto Management with SoftLedger’s API Before adopting SoftLedger, Anti Capital faced the arduous task of juggling […]

Matrix Exchange Builds a Custom Crypto Accounting Solution With Softledger Facing the challenge of identifying suitable accounting software, Matrix quickly […]

How AAG Streamlined Their Multi-Currency Accounting System With offices and investment strategists across the globe, the Anglo Andino Group grappled […]

Bitwage Manages Crypto Payroll With Softledger As a crypto payroll provider on the cutting edge, Bitwage found themselves lacking a […]

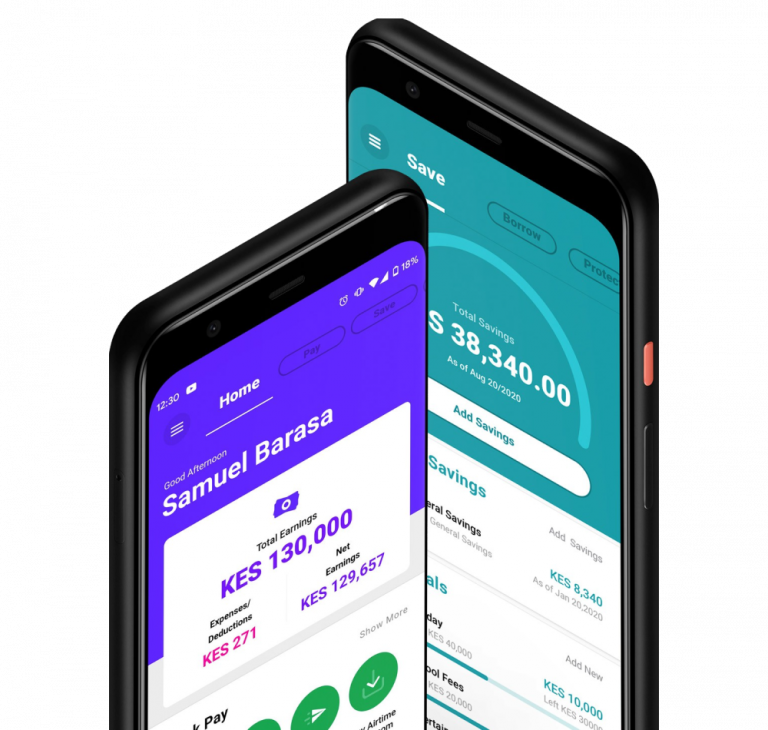

Power Leverages Softledger to Create a Nimble Digital Banking Solution Thanks to the prowess of SoftLedger’s cloud accounting platform, Power […]