If your company manages multiple entities, there are a lot of accounting complexities that you have to consider at the end of the month, like intercompany eliminations, foreign currency consolidation, and more.

In addition, small business accounting software like QuickBooks requires users to create separate accounts for each entity, which is expensive and slows down the monthly close process.

As a result, executives don’t have accurate financial data throughout the month, and your team spends a lot of time working on manual tasks.

In this post, we’ll discuss what multi-entity accounting is, how to execute an efficient multi-entity accounting process, best practices, and how to choose a multi-entity accounting software solution.

What Is Accounting for Multiple Entities?

Accounting for multiple entities is the process of consolidating all the financial statements of various subsidiaries into a single balance sheet that accurately reflects the parent company’s performance.

However, multi-entity accounting is much more complex than just adding numbers and placing the total in a spreadsheet. For example, if your entities operate in different countries, you might have to consolidate currencies and ensure your processes comply with the regulations in each country. You’ll also have to execute intercompany eliminations.

Examples of Accounting for Multiple Entities

A multi-entity company is any company that has an ownership stake in various subsidiary companies.

Here are a few examples of multi-entity companies:

- Microsoft (subsidiaries include LinkedIn and Skype)

- Meta (Instagram and WhatsApp)

- Yum! Brands (Taco Bell, KFC, Pizza Hut)

- Unilever (Dove and Dollar Shave Club)

The Multi-Entity Accounting Process

The multi-entity accounting process can be quite complex because each entity runs as an individual company.

So before consolidating entities, you have to take several key steps to ensure that the data is accurate. Here’s an overview of the multi-entity accounting process and how you can automate these steps to close the books faster.

Partial Ownership Considerations

First, there are different accounting procedures for entities depending on the percentage of each entity the parent company owns.

If the parent company owns a controlling interest (more than 50%) of the subsidiary, it should be accounted for with traditional accounting methods (adding its expenses, revenues, liabilities, assets, etc., to the parent company’s financial data).

However, if the parent company only owns a minority interest (less than 50%) of an entity, the parent company should only record its gain or loss equivalent to its ownership percentage.

For example, let’s say that the parent company owns 30% of an entity. If that entity records a gain of $10,000 in March, then the parent company should record a gain of $3,000 (10,000 x .30) on its consolidated balance sheet.

So consider the ownership status before deploying an accounting method for the entity.

Matching Fiscal Periods

Not all new entities will have the same fiscal periods. Therefore, it’s important to match them before producing a consolidated financial statement.

The maximum acceptable difference between the parent and subsidiary company’s reporting period is three months.

So what should you do if the subsidiary and parent company have reporting periods more than three months apart?

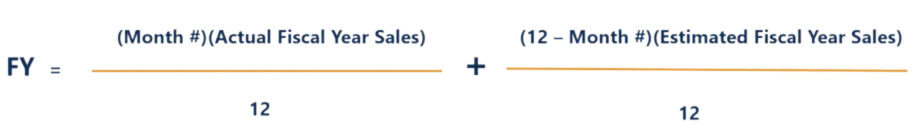

You can use the calendarization process, which standardizes reporting periods. Here’s the formula:

Currency Consolidations

If your subsidiaries deal with multiple currencies, you’ll have to calculate the exchange rates and consolidate those currencies before you can produce a consolidated financial statement.

Unfortunately, calculating currency conversions manually in Excel is often a slow and laborious process as you have to create individual cash flow statements for each subsidiary and the parent company. Then, you have to calculate each subsidiary’s cash flow statements into the parent company’s currency. Once that’s complete, you’ll have to aggregate the subsidiary’s and parent’s cash flows.

Fortunately, there are multi-entity accounting solutions that can streamline this process for you (which we’ll discuss in more detail below).

Intercompany Eliminations

By now, you’re almost ready to combine the final numbers and produce a consolidated financial statement. However, you’ve probably noticed that some transactions occur strictly between affiliates (either the parent company and a subsidiary or a subsidiary and another subsidiary).

If you combine all of these transactions immediately, it can inflate the numbers in your financial statements. For example, the business can’t generate revenue from itself.

To get started, it’s important to consider the three types of company eliminations:

- Lateral transactions: Subsidiary to subsidiary transaction

- Upstream transactions: From the subsidiary up to the parent company

- Downstream transactions: From the parent company down to the subsidiary

However, the accounting process for these transaction types differs. For lateral and upstream transactions, the transaction is visible to both the parent company and the subsidiary. On the other hand, downstream transactions are only visible to the parent company.

You can learn more about intercompany eliminations and transactions on our resource covering the topic.

Compliance When Accounting for Multiple Entities

It’s also important to regularly check GAAP and IFRS reporting guidelines and compliance regulations, especially as your company scales.

Ideally, you should have a software solution that is compliant with basic regulations, though it’s still your responsibility to regularly check for updates and ensure that you comply with the regulations – especially if you have subsidiaries operating in different countries.

The Best Multi-Entity Accounting Software

Until recently, consolidating legal entities was a laborious, manual process that often took days or even weeks to complete. This also means that executives don’t have up-to-date information to make better investment decisions.

While many general ledger software solutions and ERPs offer add-ons to consolidate multiple entities, there are often many manual processes you still have to execute, like intercompany eliminations, before the add-on can consolidate them.

In addition, if you’re still using small business accounting software, you have to pay for a different account for each entity, which can get quite expensive.

To solve these problems, we built SoftLedger, which is a general ledger accounting software designed specifically for multi-entity organizations.

It offers all the basic functionalities you need, like a chart of accounts, accounts receivable, accounts payable, and financial reporting automation.

However, its key differentiator is that it automatically consolidates your financial data in real-time.

So the instant a new transaction enters the accounting system for any entity, SoftLedger automatically performs the necessary prerequisites to consolidate the data (such as multi-currency consolidation and intercompany eliminations) and adjusts the parent company’s balance sheet to reflect the subsidiary’s new transaction.

See it in action here:

You can also drill down to any specific entity and always access an accurate audit trail.

If you have a specific request or want to implement a custom workflow, SoftLedger is highly flexible and about 95% of the platform is fully programmable via API. You can also link your bank accounts and credit cards with just a few clicks.

Despite its robust capabilities, customers say it is super easy to navigate and only requires a week or two to onboard the team and get comfortable.

To see for yourself if SoftLedger is the best solution for you, schedule a demo today.