Consolidation Accounting Software

Instantly centralize your multi-entity, multi-currency accounting with SoftLedger’s financial consolidation software.

Consolidation accounting is complex. We help you eliminate tedious manual work and super charge your productivity with automated intercompany journal entries and eliminations.

Can Your Accounting Software Manage Multiple Entities?

Consolidating the financial accounting impact of operations in multiple entities, business units, or locations in a timely and accurate manner is a complex challenge. Implementing an effective financial accounting consolidation process is key to ensure your organization has the financial data needed to make critical business decisions.

If you don’t have multi-entity accounting software that helps you seamlessly consolidate your financials, it could be holding you back from getting the information you need.

SoftLedger helps organizations consolidate their financial data as quickly as possible so the management team and other stakeholders have the data they need to make critical business decisions.

Instant Intercompany Eliminations Faciliate Accurate Financial Consolidation

With SoftLedger’s financial consolidation software, accurate real-time reporting is always only a couple of clicks away. How?

As transactions are recorded for your various business entities, the related journal entries instantly roll into your financial statements. Your intercompany eliminations are automatically calculated and booked.

Our powerful software provides you with these easy tools:

- Intercompany journal entries

- Automatic intercompany eliminations

- Multi-entity consolidated reporting at multiple levels

Streamline Your Global Multi-currency Operations

The multi-currency functionality in Softledger’s financial consolidation software allows you to run your international operations the same way you run your domestic ones.

We automate these tasks, so you don’t have to spend manual efforts doing so:

- Automatically pull FX rates with each transaction, with robust capabilities to remeasure and translate financials monthly.

- Multi-entity consolidation for family offices, investment management firms, and other global organizations.

- Users can access the system from anywhere in the world, with granular permissions and audit logs

Frequently Asked Questions

Absolutely. Our accounting software has the ability to create recurring invoices and journal entries.

SoftLedger’s AP module, with its AP aging and vendor reports, allows real-time visibility into your payable, and the ability to properly analyze your obligations.

Yes! We serve customers with operations in over 40 countries. They transact in multiple currencies and are subject to varying regulatory requirements. The SoftLedger cloud platform is perfectly equipped to manage multi-entity systems with payments in various currencies.

Yes! We serve customers with operations in over 40 countries. They transact in multiple currencies and are subject to varying regulatory requirements. The SoftLedger cloud platform is perfectly equipped to manage multi-entity systems with payments in various currencies.

Explore Customer Stories

Ecogy Energy Streamlines Multi-Entity Accounting See how Softledger played a pivotal role in facilitating the optimization of Ecogy Energy’s payables […]

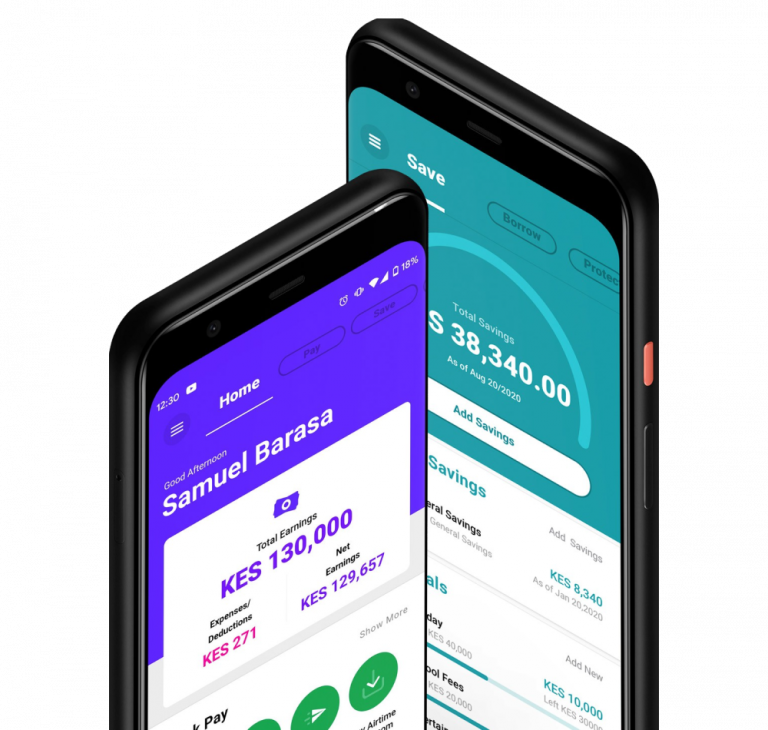

Power Leverages Softledger to Create a Nimble Digital Banking Solution Thanks to the prowess of SoftLedger’s cloud accounting platform, Power […]

Bitwage Manages Crypto Payroll With Softledger As a crypto payroll provider on the cutting edge, Bitwage found themselves lacking a […]