There are plenty of accounting software solutions for the healthcare industry, but the best solution varies depending on the use case.

For example, a small clinic with a single accountant requires a simple accounting tool that’s easy to use and offers limited features to avoid overwhelming the user. On the other hand, a hospital or enterprise healthcare organization with complex accounting processes requires a solution that offers sophisticated automation, controls, and advanced user permissions.

So to help you find the best healthcare accounting tool for your organization, here’s a detailed analysis of some of the top medical accounting platforms.

Best Accounting Software for Hospitals and Enterprise Healthcare Organizations

All of the healthcare accounting platforms in this category are designed for more advanced organizations with one or more accountants managing the company’s finances.

Therefore, you can expect each solution to offer core accounting features, like a general ledger, accounts payable, accounts receivable, workflow automation, and financial reporting.

So rather than discussing basic features, we’ll analyze key differences between each solution to help you make the best decision for your business.

Flexi

Flexi is an alternative to traditional ERP accounting solutions for enterprise organizations that want more simplicity and personalized support. It offers cloud and on-premise options and can also be used as a white-label solution.

Users can purchase access to the entire Flexi platform or its three main modules individually:

- Financial Management Suite: This includes the core accounting features like accounts receivable, accounts payable, fixed asset management, account reconciliations, and financial reporting

- Accounting Automation: This is the workflow solution that allows users to set specific rules so that Flexi can automate processes like purchasing and accounts payables, contract management, document compliance, asset management and tracking, and employee travel and expense management.

- Automation Apps: For processes that Flexi doesn’t natively offer in its accounting systems, it leverages apps to automate. Some of these apps include payment approvals, journal entries, invoice approvals, and procurement.

Reviews appreciate that it’s easier to use and implement than traditional ERP systems, making it easier to streamline basic accounting processes.

Pricing

Flexi doesn’t list its pricing publicly.

Netsuite

Netsuite is a full ERP platform for enterprise organizations. So in addition to its accounting functionality, Netsuite also comes with CRM, eCommerce, manufacturing, and human capital management modules.

Like the other enterprise accounting solutions on this list, the main benefit of Netsuite is that it automates most of the tedious processes traditionally executed in spreadsheets, which helps you close the month faster and reduce human errors.

However, it’s worth noting that some of the automation features, like multi-entity and multi-currency consolidation, are only offered as add-ons.

Netsuite also offers API access so that you can build your own integrations, though you must have a programmer with proprietary knowledge of Netsuite’s programming language to execute the integrations.

The average implementation timeline is usually several months, and third-party sources estimate that the average implementation is anywhere between $25,000 to $100,000.

While Netsuite doesn’t offer detailed pricing information on the website, the pricing structure is based on the modules you use, the number of users added to the platform, and a flat fee for the core platform.

Pricing

While Netsuite doesn’t publicly list its pricing, here’s a third party guide that can help you estimate costs.

SoftLedger

Most accounting software solutions fall into one of two categories:

- ERP systems that offer advanced automation, yet are difficult to navigate and expensive to implement (and usually still require users to execute some manual data entry in a spreadsheet).

- Small business accounting software that is easy to implement and use yet lacks advanced controls, automation, or functionalities that larger organizations require.

So we decided to create a solution that offers the best of both worlds. Today, SoftLedger is that solution.

It’s a cloud-based platform that offers the advanced controls, automation, and features that enterprise organizations require, yet it’s still easy enough to use that even small medical practice owners can operate it.

In addition, the average implementation time is just 45 days, and it requires minimal technical resources to implement, thanks to modern coding practices.

Below, we’ll walk through some of the key differentiators of the platform to help you understand why SoftLedger’s healthcare accounting software is a much more efficient option than legacy ERP solutions.

Real-Time Data Enables Best-In-Class Automation Capabilities

With traditional accounting software, accountants create an entry and then have to manually update all impacted accounts (typically at the end of the month). This slows down the month close process, and the manual labor increases the likelihood that errors will crop up in your financial data.

To solve this problem, SoftLedger offers real-time data.

This means that the instant a new transaction enters the system, SoftLedger automatically adjusts all impacted accounts. For example, if your cash flow enters through Stripe payments, SoftLedger automatically enters them into the general ledger accounting software so that you know exactly how much cash the company has at any given moment.

This system ensures you never have unwelcome surprises at the end of the month, and it speeds up the month-close process.

Automatic Multi-Entity and Multi Currency Consolidation

Many larger healthcare organizations have multiple subsidiaries and deal with foreign currencies.

Today, most ERP systems offer automatic consolidation add-ons, though they aren’t perfect solutions. First, you typically have to pay extra for the add-on, and they also aren’t built to prepare the data for consolidation, meaning you’ll still have to do some manual work in a spreadsheet before consolidating it.

For example, if you’re consolidating multiple entities, you might still have to perform intercompany eliminations manually in a spreadsheet before using the consolidation tool.

However, SoftLedger automatically executes these additional processes involved in the multi-entity and multi-currency consolidation process before executing the consolidation process. This also ensures that the data inside the general ledger is truly accurate and updated in real-time.

Limitless Flexibility With an Open API

Most enterprise-grade accounting platforms allow users to build integrations through an API. However, many of their APIs are difficult to use. Specifically, you need a developer with proprietary programming knowledge of that platform to build the integration, and even then, it’s a time-consuming process.

In contrast, SoftLedgr has a REST API that makes it super easy for any developer to build any integration quickly. In fact, the entire SoftLedger platform is fully programmable via API, meaning users can perform any function in the user interface via API.

This gives you unlimited flexibility, and developers can easily build their own integrations without worrying about proprietary protocols.

Modern UI That’s Easy to Use

One of the key issues with traditional ERP software is that the advanced functionalities make them difficult to use. So even after the software is implemented in your organization, it can still take weeks to onboard new employees. Training time wastes valuable human resources, and if employees don’t feel comfortable using the platform, they’ll likely give up altogether, which wastes the investment.

With SoftLedger, customers report that their team feels comfortable using the platform in a few days. So whether you’re a CFO, CPA, or business owner, you’ll be able to use the platform.

It’s also super easy to build custom dashboards with a drag-and-drop editor and intuitive navigation.

To see for yourself how easy SoftLedger is to use, schedule a demo today.

Pricing

Best Accounting Software for Small Clinics and Private Practices

Here are a few different options for smaller healthcare providers that need a simple solution to securely execute basic accounting tasks.

Xero

Xero is a cloud-based small business accounting solution that’s well-known for its ease of use and simplicity. It’s perhaps the most simplistic small business accounting platform, though this makes it an excellent choice for small business owners and solopreneurs who execute their own accounting processes.

You’ll be able to access all of the basic accounting features you need, like invoicing, expenses, bank reconciliation, and even payroll.

A key benefit of Xero is that it also integrates with PayPal and Stripe, making it easier to accept payments than some other small business accounting platforms.

Xero also makes it easy to work with multiple currencies, so if you have international clients and partners, it might be a good option.

Finally, Xero’s pricing structure is based on a flat subscription fee that includes unlimited users, bank transactions, invoices, and contacts, which makes it cost-effective as you scale. The downside is that it doesn’t offer as many advanced features or customization as a tool like QuickBooks, so you may have to switch as you scale.

Pricing

Freshbooks

Freshbooks is a great option for solopreneurs and small business owners that want a simple platform to manage basic accounting processes.

Invoicing is very easy with Freshbooks’ customizable invoice templates, which you can send directly from the dashboard. Expense tracking is also simple, as you can add vendors directly to your dashboard, identify recurring expenses, and other customization options.

Another area that Freshbooks excels in is time tracking. This feature is available on all plans, and while users can record project hours manually, they can also track time through the mobile app or a third party like Asana.

Unfortunately, Freshbooks doesn’t offer as many customization options as a tool like QuickBooks, though this also makes it a much easier platform to navigate.

Pricing

QuickBooks

QuickBooks is perhaps the most robust option for small to medium-sized businesses with a team of employees, partners, and a sizable client base.

It offers most of the same features as Freshbooks and Xero, along with more advanced features like QuickBooks Payroll and QuickBooks Point of Sale so that it can scale with your business. In addition, QuickBooks has the largest selection of app integrations of all the small business accounting platforms, so it’s much easier to customize for specific use cases.

Overall, QuickBooks is definitely the most scalable of the small business accounting solutions, though that also means that it’s more complex and can be intimidating for beginner users.

It’s also worth noting that if you scale beyond a single entity (e.g., you have multiple locations), QuickBooks requires users to pay for an individual account for each entity. So if you scale beyond a single entity, it’s probably best to upgrade to a more sophisticated enterprise accounting platform.

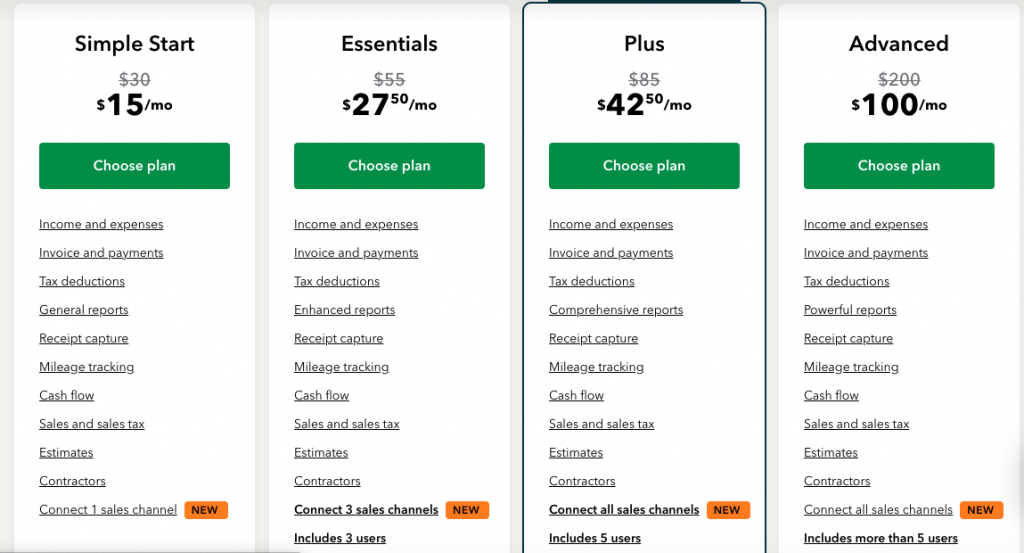

Pricing

Best Free Healthcare Accounting Software

You might not need a full accounting platform if you have a simple clinical practice and do most of the accounting processes yourself. In that case, here are a few different free healthcare accounting apps that still enable you to track cash flow.

Wave

Wave is one of the most popular free accounting platforms that allows you to send invoices, collect payments, and track expenses. It also offers basic financial statements like profit and loss statements, a balance sheet, and a cash flow statement.

Wave even allows you to execute more advanced processes like payroll, with timesheets, tax forms, and more.

It’s perhaps the most robust free accounting software and is super easy for non-accountants to navigate.

Wave’s pricing model is also quite simple. All of its features are free (with the exception of payroll), and the only way it makes money is by collecting payment transaction fees and accounting coaching/bookkeeping support.

Pricing

Zoho Books

Zoho Books is also a competitive alternative to Wave, allowing businesses with turnover below $50,000 per annum to use it for free.

Inside the free plan, you’ll have access to all the basic features like:

- Contacts

- Invoicing

- Expenses

- Online payments

- Banking

- Reporting

You’ll also have access to a mobile app to do your accounting on the go.

Perhaps the biggest difference between Wave and Zoho Books is that while Wave’s entire platform is completely free, Zoho Books locks some of its more advanced features behind a higher pricing tier. For example, you’ll have to upgrade for features like tracking project expenses and invoices, reporting tags, timesheet and billing, and other more advanced features.

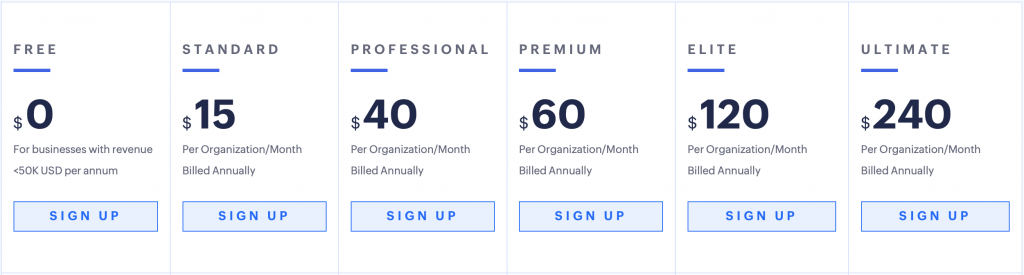

Pricing

ZipBooks

ZipBooks is another platform that offers a free plan for small businesses and solopreneurs, and it also allows users to scale up to a paid plan with more advanced features as they grow.

A few features it offers on its free plan (unlike Wave and Zoho Books) include time tracking and expense by project. It also offers 1099 contractor management features to make taxes easier. This is a handy feature as most solopreneurs and small businesses leverage contractors.

Unfortunately, ZipBooks does not offer inventory tracking, multi-currency capabilities, or receipt tracking on its free plan.

It also blocks a lot of automation features like automatic and recurring invoicing/billing and automatic payment reminders.

Pricing

Choose a Healthcare Accounting Software Today

Whether you’re looking for robust accounting software that makes it easy to manage accounting processes for multiple entities intuitively or simple accounting software for basic invoicing and expense tracking, one of the solutions above should be able to help you.

If you’d like to see how SoftLedger has helped other healthcare organizations improve their accounting processes, schedule a demo here.