As your company grows and the accounting processes become increasingly complex, you’ll find that small business accounting software is no longer an efficient solution for financial reporting. The closing process creeps from days to months, causing executives to make significant decisions based on increasingly dated information. To help speed up this process, you need financial reporting automation software.

In addition, complex accounting processes executed manually expose your data to more opportunities for error that can impact the business’s decisions and create problems during an audit.

Fortunately, financial reporting automation can solve these problems by enabling accountants to:

- Turn around financial statements faster

- Improve accuracy

- Prepare for audits with ease

This post discusses the key benefits of financial reporting automation, what to look for when choosing a product, and some potential solutions.

What is Financial Reporting Automation?

Financial reporting automation is incorporating software into the accounting process to ease tedious tasks that accountants otherwise perform manually. Depending on the selected software, you can automate reporting tasks like:

- Reconciliations

- Financial statement preparation

- Intercompany consolidation

4 Benefits of Financial Reporting Automation

Here are a few of the top benefits of financial reporting automation:

1. Close the month faster and operate on up-to-date data throughout the month

Manually creating reports is time-consuming and may take weeks to complete, depending on the complexity of your accounting processes. This means executives are operating on inaccurate data. It is placing the company at a disadvantage as this could lead to overspending or poor investment decisions.

However, financial reporting automation (specifically, a solution that offers real-time data) can solve this by automatically executing calculations and adjusting impacted accounts the instant a transaction enters the system.

For example, let’s say that a brand typically budgets about $50,000 per month on ad spend. However, perhaps the ad spend doubles for that month.

A company that executes financial reporting manually wouldn’t know until midway through the following month that they have overspent. By that point, there’s no way to course-correct as the damage is already done.

However, a company that uses a financial reporting automation tool with real-time data would know the day ad spend went over the normal budget. This places the company in a proactive position as it can adjust its budget accordingly and make better investment decisions.

2. Spend less time performing tedious tasks and more time on high-level activities

As the complexity of your company’s accounting system grows, the accounting team will spend more time performing tedious tasks. For example, manually importing data into spreadsheets.

This is exactly what happened with Cipherpoint, one of our customers.

Their team spent weeks (each month!) manually importing necessary accounting data into spreadsheets. This meant they had very little time for any other high-level tasks.

However, after adopting our financial reporting automation tool, they reduced the time spent manually importing data from weeks to days. As a result, employees were able to instead focus on acquiring new customers.

3. Minimize reporting errors and ensure all data is accurate for executives and auditing

Regardless of how diligent your employees are, there’s always a chance that they enter a number incorrectly or forget to adjust an impacted account.

However, financial reporting automation software automatically calculates all the data for you and adjusts impacted accounts. This way, you have peace of mind knowing that the majority of your accounting process is immune to human errors, and your team no longer has to spend time double-checking calculations.

4. Access accurate paper trails in seconds so that auditing prep takes minutes rather than weeks

Preparing for financial audits manually requires you to locate and pull supporting documentation from a variety of sources. This can take days or even weeks to complete.

However, financial reporting automation makes it easy to access accurate paper trails in seconds. All you have to do is select the report you want and drill down to the data you need.

It also makes it easy to solve discrepancies and questions that arise as you’ll have access to a full backlog of historical data.

Read also: How to Get the Most out of Your Financial Reporting Software

What Processes Can You Use Financial Reporting Automation?

This depends largely on the automation tool you select, but a good one will enable you to automate all of these reports:

- Annual Financial Statements

- Quarterly Financial Statements

- Consolidation Purposes

- Management Reporting

- Financial Statement Analysis

- Year-End Close

- Post Audit Reclassification

At SoftLedger, you can generate all of these reports with a click of a button, so as you’re choosing a financial report, be sure to look at the process to produce a report.

To see how easily you can automate your financial reporting processes in SoftLedger, book a demo today.

What Does a Good Financial Reporting Automation Tool Look Like?

While all financial reporting automation tools offer some kind of reporting automation, not all of them deliver the same experience and efficiency.

To help you make the best selection, here are some questions to ask when selecting a financial reporting automation tool:

1. How many steps does it take to produce an automated report?

Some financial reporting solutions enable you to produce a report with the click of a button. However, other software may only automate a portion of the process while you still have to complete the rest of it manually.

For example, let’s say you have multiple entities. Some software requires you to still bring all of the transactions into one pane before automatically creating the reports. While this is easier than manually performing the entire process by hand, there are other solutions (which we’ll discuss below) that automate the entire process.

2. How complex is the setup process and does it require extensive training?

As you move beyond small business accounting software, you’ll find that most ERP systems require involved setup processes and extensive training. For many businesses, the extensive features offered by these ERP systems are unnecessary (even if you have outgrown small business accounting software).

Therefore, ask the financial reporting automation company what their onboarding and training process looks like and approximately how long it typically takes.

You can also read reviews on sites like G2 and Capterra to see what customers think about the company’s onboarding process.

3. How easy is it to get data into the system?

Some solutions make it very difficult to get data into the system as it requires someone with proprietary programming knowledge of that system. Therefore, make sure the system you choose offers an open API (such as a REST API) that enables you to easily get data into your system.

4. Can you customize the dashboards?

Many businesses have to add unique categories to their reports. For example, a dental software company might have a custom code for vendors. In that case, the accounting team needs to go in and add that to the financial reports so that it is included when you create reports.

Without customizable dashboards, you may have to export the file to Excel, do a V-lookup to grab the data, and then go back and add it to your reports.

5. Can you directly connect your financials on a transactional level?

In traditional reporting automation software, you have to book all of your entries and then consolidate them at the end of the month. This means you still have to go through a batching process before the software generates the reports.

However, more modern software now enables you to connect financials on the transactional level. Therefore, you’ll be able to generate automated reports without any additional steps, saving you time and reducing steps that expose your accounting process to potential manual errors.

6. Do they offer responsive support?

Whatever partner you choose should be fairly responsive and offer handheld assistance during the onboarding process. The best way to evaluate a company’s responsiveness is to read reviews and try out the company for yourself.

The Best Financial Reporting Automation Software

Below are a few of our favorite financial reporting automation tools. We’ll first discuss our own tool, and then offer a few alternative solutions that might be a good fit for your business.

- Best for multi-entity companies who need accurate, real-time reporting: SoftLedger

- Best for companies that are looking for an on-premise solution: Prophix

- Great for companies of all sizes and sectors: LucaNet

- Best for enterprise companies looking to automate tedious processes: Workday Adaptive Planning

- Best for companies looking for a straightforward reporting solution: Board

SoftLedger

SoftLedger was built after founder Ben Taylor was frustrated that there wasn’t a tool that was more adept at handling complex accounting processes. He wanted something more than a small business accounting software, yet an easier user experience than ERP systems (which have features most businesses never need).

He built SoftLedger as the solution.

SoftLedger contains a simple financial reporting automation tool that is easy to use and flexible, yet still powerful and efficient at automating processes. And most of all – it helps to reduce the time spent manually creating financial reports.

Here are a few key reasons customers use SoftLedger as their financial reporting automation tool.

1. Easily structure reports with drag and drop features

With traditional financial reporting automation software, the user typically has to go into the code to adjust the structure of the report.

However, SoftLedger makes it easy to adjust reports with simple drag and drop features.

Similarly, if you need to add custom dimensions to your journals, you can easily do so and see it reflected in your financial reports.

2. All transactions are immediately reflected in reports for multiple entities (there’s no process to bring them in)

If you have multiple entities, most financial reporting automation software requires users to book all entities and then manually consolidate them into a single pane at the end of the month.

This means you’ll have to take an extra manual step at the end of the month, which takes additional time and exposes your accounting process to an opportunity for human error. In addition, you won’t know how the company is doing during the month as you’ll have to wait until the end of the month when the data is consolidated.

SoftLedger is different because as soon as one entity books an entry, it immediately shows up across all impacted accounts, thanks to real-time data. Therefore, multi-entities can generate reports with just one click (they don’t have to bring any data in), which saves time and reduces the chance of human error.

3. Calculates multiple currencies the moment the transaction is entered

If your company deals with multiple currencies, SoftLedger immediately applies the exchange rate so that you have access to accurate data at any time of the month.

This is unlike traditional accounting systems that require you to manually apply the exchange rate, slowing down the reporting process.

Even if the company does claim to offer multi-currency consolidation, many tools wait until the end of the month to apply the exchange rate, causing the company to operate with inaccurate data throughout the month. Therefore, it can be a surprise when the reports generated don’t match the data you previously looked at in your dashboard.

4. Connect your financial data on a transactional level

SoftLedger connects your financials on a transactional level. As a result, making it easy to drill in and see what happened during the month. It also eliminates data replication issues because you’re always connected to the source data.

This is unlike traditional reporting automation software that requires you to book entries and then consolidate them at the end of the month.

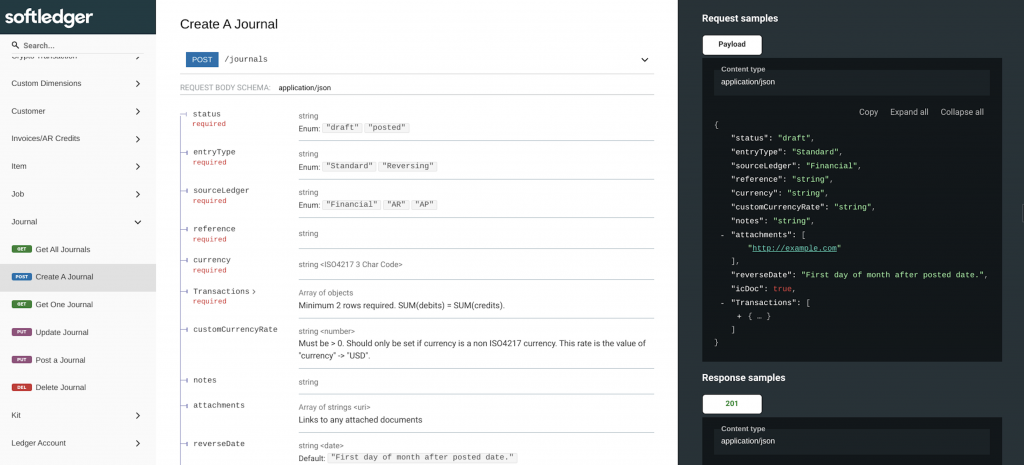

5. Easily import data from any system with our REST API

SoftLedger uses a REST API, making it easy for developers to connect with virtually any data source. This means your developers don’t need to have proprietary knowledge of the system’s programming language and you’re also not limited to the integrations offered by the software.

6. Recurring Journal Function

SoftLedger’s recurring documents feature allows users to automate the generation of invoices, bills, and journal entries on a regular schedule, significantly enhancing efficiency in financial management. Users can set up recurring templates for these documents, specifying details such as frequency, start and end dates, and amounts. This automation ensures timely and consistent processing of routine transactions, reducing the manual workload and minimizing the risk of errors. The system also provides flexibility with options to review and approve each document before finalizing, offering control while maintaining efficiency. By leveraging this feature, businesses can streamline their accounting operations, ensuring accuracy and saving valuable time.

7. Friendly UI makes it easy to learn, and setup requires a matter of weeks

Complex ERP systems typically offer much more power than what most businesses need. For example, a company using QuickBooks Online may have only a few employees in its accounting department. The additional complexity that comes with an ERP system means that the onboarding and training processes typically last several months. This makes it much more likely that employees will make mistakes.

We wanted to solve this problem by creating an accounting tool that offers more control and automation than traditional small business accounting, yet can still be operated by any accountant with just a few weeks of training.

In addition, the average SoftLedger customer’s setup time is a matter of weeks, and you’ll have access to a responsive support team to hold your hand through the process.

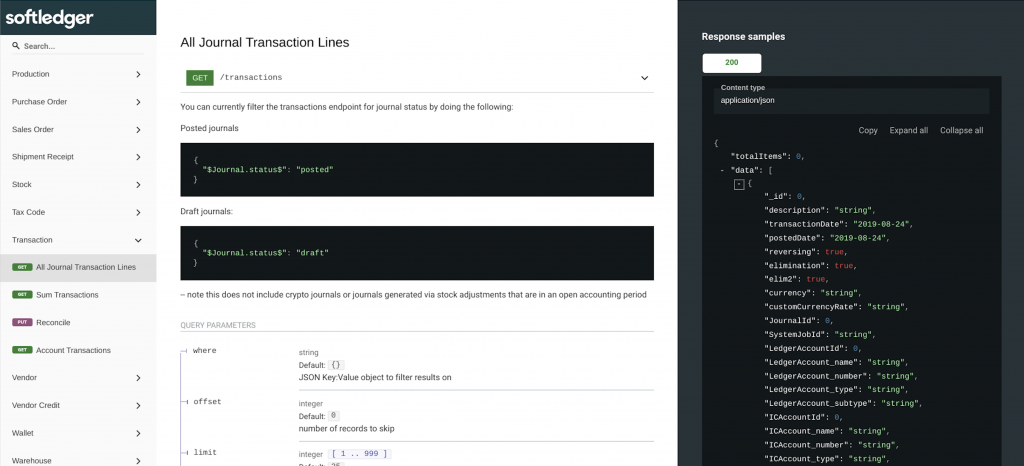

Pricing

If you need more power than a small business accounting tool yet less complexity than a traditional ERP, see the SoftLedger platform for yourself in a demo today!

Prophix

Prophix is CPM software that offers cloud-based and on-premise solutions for larger and small companies. It automates processes like budgeting, planning, consolidation, and reporting. Users state that it enables you to create reports on individual business unit data all the way up to board and executive-level reports. You can also easily access and compile ad hoc reports as needed.

If you’re doing everything in Excel and want an alternative, consider Prophix.

- Reviews

- Pricing Info Not Available

LucaNet

LucaNet is reporting software that has cloud and on-premise options and claims to serve “companies of all sizes and sectors”. It claims to offer rapid implementation and offers management reporting, BI and dashboarding, and disclosure management.

Customers say it is intuitive, flexible, and offers fast consolidation.

- Reviews

- Pricing Info Not Available

Workday Adaptive Planning

Workday Adaptive Planning is an FP&A solution. It is specifically designed for enterprise companies that want to automate tedious processes and generate smarter insights faster. Customers love its modeling and analytics capabilities and that it is relatively user-friendly. For example, you can copy and paste from Excel directly into the platform.

- Reviews

- Pricing Info Not Available

Board

Board is CPM software offering reporting capabilities that enable you to filter, sort, and drill down into your data sets.

Building a report is straightforward as it doesn’t require any coding and can be used across any device. You can also choose to create static or interactive reports and schedule them to send automatically to key stakeholders.

Reviewers say that it is relatively easy to set up and can handle large amounts of data well.

- Reviews

- Pricing Info Not Available

Final Thoughts

If you’re still creating all of your financial reports manually, financial reporting automation software can help you and your team:

- Invest more time in higher-level activities

- Get critical data to executives faster

- Reduce human errors

- And so much more…

For financial reporting automation that is less complicated than large ERP systems yet still offers the advanced capabilities that small business accounting software lacks, schedule a demo with SoftLedger today. We’d love to see how many hours we can help your team win back!