In the ever-evolving landscape of modern accounting, the ability to track and verify financial data is paramount. As businesses become increasingly data-driven, ensuring the integrity and transparency of financial records is crucial. This is where the concepts of data provenance and auditability come into play. Together, they form the backbone of reliable and trustworthy accounting systems, enabling organizations to understand and confirm the source of their data and to monitor any actions taken within the system. Setting up your accounting software to automatically incorporate auditable data provenance pays dividends for a company, particularly as an organization scales and increases volume of data. If your accounting platform is not capable of incorporating these covenants into day to day practice, you will spend time and money determining the source and accuracy of data flowing in and out of your general ledger. At SoftLedger, we strive to ensure your valuable time and money is used efficiently and effectively.

The Importance of Data Provenance

Data provenance refers to the comprehensive documentation of the origins and history of data throughout its lifecycle. In accounting, this means tracking every transaction from its initial source to its final entry in the financial statements. This meticulous tracking is essential for several reasons:

- Transparency: It allows stakeholders to see the entire journey of each data point, fostering confidence in the financial records.

- Accuracy: By knowing the exact source and transformation of data, businesses can ensure their financial statements are accurate and error-free.

- Compliance: Regulatory bodies often require detailed records of financial transactions. Data provenance helps meet these requirements by providing a clear, traceable history of all data points.

Ensuring Robust Auditability

Auditability is the ability to verify and validate the accuracy and integrity of financial data. A robust accounting system must ensure that every transaction can be traced and audited. This is achieved through:

- Detailed Records: Keeping comprehensive logs of all transactions, including any changes or deletions.

- Clarity: Making data trails clear and easy to follow from creation to reporting.

- Verification: Enabling auditors to track the origin and processing of each data point.

Auditability is critical for maintaining the credibility of financial statements and ensuring regulatory compliance. It provides a mechanism for verifying the correctness and authenticity of financial records.

The Role of Data Provenance and Auditability in Modern Accounting

Incorporating both data provenance and auditability into accounting practices offers several significant benefits:

- Enhanced Decision-Making: With accurate and traceable data, businesses can make informed decisions based on reliable financial information.

- Increased Trust: Stakeholders, including investors, regulators, and auditors, gain confidence in the financial statements, knowing that all data is transparent and verifiable.

- Improved Efficiency: By automating data tracking and audit processes, businesses can reduce the time and effort required for manual checks, thus increasing operational efficiency.

Combining Data Provenance and Auditability

SoftLedger believes that while data provenance ensures that the source and history of data are clear and transparent, auditability ensures that every action taken within the system is recorded and verifiable. This combination provides a comprehensive view of financial data, from its origin to its current state, making it easier to identify and rectify any discrepancies.

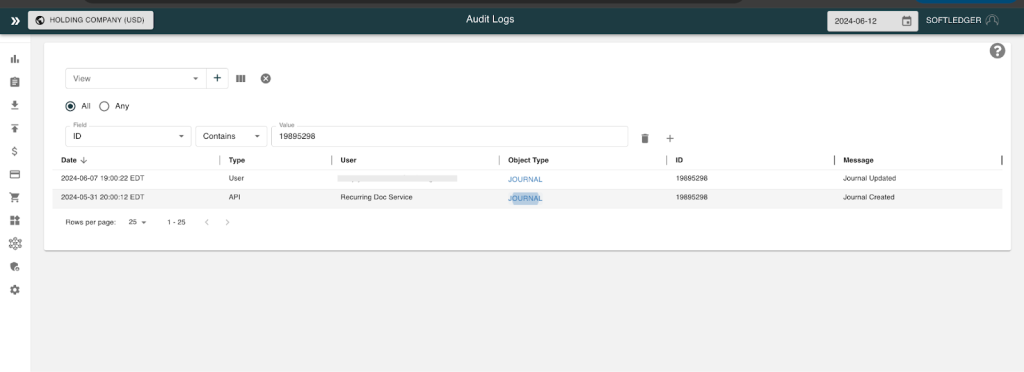

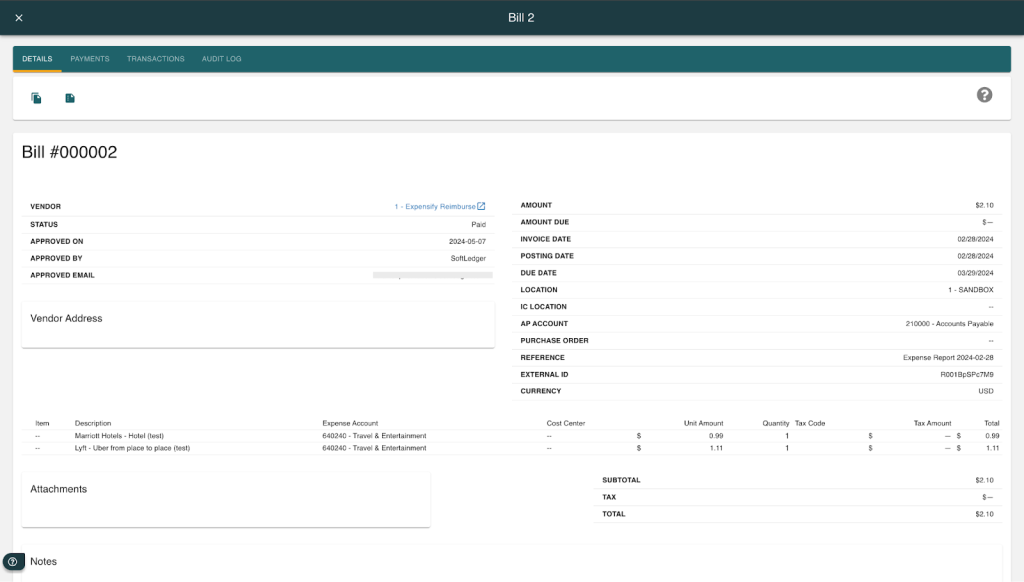

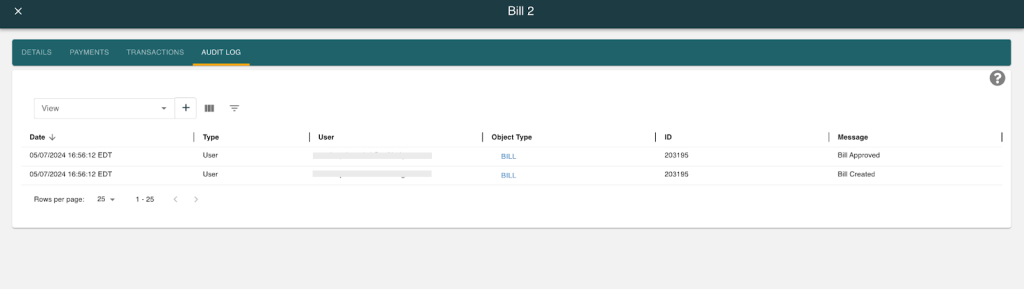

SoftLedger is designed to help businesses achieve this vital combination of data provenance and auditability. With its transactional external source fields and robust audit logs, SoftLedger provides the tools necessary to track and verify every piece of financial data.

- Transactional External Source Fields: These fields capture detailed source information for each transaction, ensuring that the origin of all data points is transparent and traceable.

- Robust Audit Logs: SoftLedger’s audit logs meticulously record every action within the system, including data creation, adjustments, and deletions. This ensures that every change is documented and can be easily traced back to its source.

By integrating these features, SoftLedger enables businesses to maintain accurate and reliable financial records, enhance transparency, and streamline compliance with regulatory requirements. By leveraging the inherit data provenance and audit features of SoftLedger, you will be better prepared for any internal/external audits, and have a better understanding of your data flows and structure, which in turn allows for more accurate and insightful reporting.