For companies that deal with thousands of transactions each month as well as other complexities, like multiple currencies and entities, the financial close process can be time-consuming and challenging.

It’s also easy for errors to crop up that could sacrifice the data’s accuracy.

Fortunately, a solid financial close process can fix this problem. In this post, we’ll discuss what the financial close is, walk through an eight-step checklist to execute the process, and provide automation solutions.

What is a Financial Close Process?

The financial close process is the act of recording, reconciling, and reviewing all business transactions to create accurate financial reports.

Accounting teams typically execute the financial close process monthly (known as the month-end close) or annually (known as the year-end close).

The close provides an accurate snapshot of the company’s financial health for executives and stakeholders, though it’s also a fiscal reporting requirement for some companies.

The details of the financial close process depend on the size of a company and the number of financial transactions completed. Nonetheless, here are the typical steps taken by accountants and financial teams during a financial close:

- Enter all customer and vendor invoices into an accounting system.

- Reconcile all bank accounts and inventory assets in an accounting system. This includes reconciling bank statements with payments between businesses.

- Produce financial statements, including a profit and loss statement, a balance sheet, and a cash flow statement.

- Carefully review all the statements.

- Close the period modules in the accounting system.

Common Financial Close Process Problems

Manually executing the financial close process is problematic for a few reasons, including:

- Monotonous, manual data entry that requires significant human resources

- Simple, manual errors can crop up and make the data inaccurate

- Missing receipts and other necessary documents that the team has to find

- Unidentifiable payments

- Duplicated line items that could even be fraudulent

How to Execute the Financial Close Process Manually (8 Step Checklist)

As each company has a slightly different accounting process, there isn’t a step-by-step process, though you can use this checklist as a guide.

Step 1: Record Income and Expenses

Record any income received, including sales, investments, and any other revenue the business earned.

Then, record all expenses such as supplier payments, insurance, utility bills, payroll, and loan interest.

Step 2: Update Accounts Receivable and Accounts Payable

Now, make sure the accounts receivables and accounts payables are up to date.

Here are some specific steps to close the accounts receivables:

- Create an aged debtors report (e.g., invoices you can expect to be paid within 30 days, 60 days, etc.)

- Send reminders to customers who’ve exceeded their credit period.

- Account for discounts and recognize bad debt.

Here are a few steps to ensure invoice payments are on time:

- Create an aged creditors report.

- Note overdue invoices for immediate payment.

- Look for any mistakes, including duplicate invoices.

- Avoid duplicate payments.

Step 3: Prepare Account Reconciliations

Account reconciliation is matching and verifying each transaction with a corresponding bank, vendor, or business to double-check your bookkeeping is accurate.

Here’s how you can execute the reconciliation process:

- Check ending balances, deposits, and withdrawals of your bank statements against your cash book.

- Identify discrepancies (e.g., uncleared checks, internal record errors, and bank charges)

- Adjust the journal entries.

- Create a record of your bank reconciliation.

Step 4: Review Inventory

If your business has inventory, count existing inventory and update the numbers in your books. From there, check inventory levels, how often you order, and the price you page.

Step 5: Review Fixed Assets

Here are a few steps for your fixed asset review:

- Record all purchases, improvements, and sales of fixed assets

- Account for depreciation and amortization expenses

- Record other expenses, such as repairs and maintenance

- Review the condition of your fixed assets

- Adjust accrued and prepaid expense accounts to reflect any income received and expenses paid during the month.

- Double-check your prepaid accounts with your expense accounts to avoid duplicate payments.

Make sure you pay any accrued liabilities when they’re due. This way, you won’t damage your business’s credit reputation and will continue to have access to credit.

Step 7: Prepare Financial Statements

Next, prepare the following financial statements:

- Income statement/profit and loss statement

- Balance sheet

- Cash flow statement

Step 8: Review Your Financial Information

Finally, check your work one last time to ensure it’s accurate.

Once the books are closed, you can’t go back and make further adjustments, so take your time during the review process.

How to Improve the Financial Close Process With Automation

As you can see, the process above is time-consuming for companies that handle hundreds or thousands of transactions each month.

We realized that it was a major issue that small business accounting software doesn’t automate the financial close process while more advanced ERP solutions are often too expensive and complex for the average mid-level company.

So we built SoftLedger to solve this problem.

SoftLedger is a cloud accounting solution designed to automate not only the financial close process but also all of the prerequisite steps that go into closing the books.

For example, if you have crypto transactions, you need to calculate the cost basis and gains/losses before booking the journal entry. So we designed SoftLedger to automate all of these prerequisite calculations as well so that it can then create the journal entry.

As a result, SoftLedger is always able to provide up-to-date, real-time data. This means that when it comes time to execute the financial close process, there’s very little work to be done before commanding SoftLedger to close the books automatically.

So once it is time to close the books, here’s a brief overview of how SoftLedger automates the process (or you can access a more detailed overview here).

Step 1: Create Accounting Years

The first step is to add the necessary fiscal accounting years to cover your transactions.

For example, if the first transaction in your system is March 18th, 2021, the first accounting year would need to start from January 1st, 2021. If there are more transactions from 2022 onwards, accounting years would need to be added.

Step 2: Add the Necessary Ledger Accounts for the Close

Next, set the following accounts:

- Accumulated Other Comprehensive Income

- Other Comprehensive Income Account

- Retained Earnings Account

- Foreign Currency Gain/Loss Account

Step 3: Confirm All Activity Has Been Added and Posted

Your books can be closed once all your activity has been created and posted.

This means that all journal entries, bills, invoices, and other transactions must go through the activity statuses.

Step 4: Review Reports to Confirm Balances Are as Expected

Now review the reports and make sure that the balances are in line with what you were expecting. While the exact reports vary from different businesses, here are some of the most common ones:

- Balance Sheet

- Income Statement

- Trial Balance

- General Ledger Summary

- Aging Reports (AP & AR)

- Reconcile

- Crypto Coins page as of end date of period

- Stock page

Step 5: Close the Tasks in the Accounting Periods Module

Once all the above has been completed and confirmed, the tasks for each module can be closed for the reviewed period.

After clicking the “lock” icon to close each task, the system will check to see if there are any draft status documents for the period. If there are, SoftLedger will restrict users from closing the period.

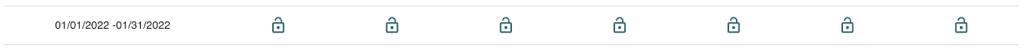

An open period will look like this:

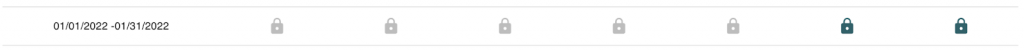

And a closed period will look like this:

As you can see, SoftLedger makes it super easy to automate the entire financial close process. This way you can close the books in a matter of minutes rather than days and you’ll always have access to up-to-date financial data throughout the month.

Automate The Financial Close Process Today

While it’s possible to execute the financial close manually, SoftLedger can save you hours of valuable human resources that can be reallocated to more important tasks. In addition, the accounting team can be confident that the data is accurate and reliable for stakeholders, executives, and auditors.

To see for yourself if SoftLedger is the best solution to help you close the books faster, you can schedule a demo today!

Why You Need Financial Reporting Automation