When foreign currency is involved in financial reporting, foreign exchange rate fluctuations can create unrealized gains and losses that inaccurately reflect a company’s financial performance.

When making future investment and operational decisions, these inaccuracies are problematic for executives and stakeholders. They can also lead to reporting challenges from a tax perspective.

To solve these problems, foreign currency translation is a critical process that accountants must execute to realize these gains and losses. The process ensures that a company’s financial statements are accurately consolidated into their functional currency.

What Is a Foreign Currency Translation?

Foreign currency translation converts foreign currencies into the parent company’s functional currency and then balances exchange rate differences.

The foreign currency translation process is necessary if a company operates in multiple countries, transacts in different currencies, or a parent company has foreign subsidiaries across different countries. This is because exchange rates can create unrealized gains and losses that can lead to inaccurate financial statements.

To illustrate how foreign currency exchange rates can create unrealized gains and losses, consider the following example.

Let’s say Company A (based in Spain) purchases office supplies from Company B (based in the US) on September 14th. Company A’s functional currency is Euros, and it agrees to pay 80,000 EUR for the equipment in 30 days. However, Company B’s functional currency is US dollars, and it records the accounts receivable transaction in USD.

For simplicity, let’s assume that on the date of the transaction agreement, 1 EUR is equivalent to 1 USD. So the exchange rate from EUR to USD is 1.

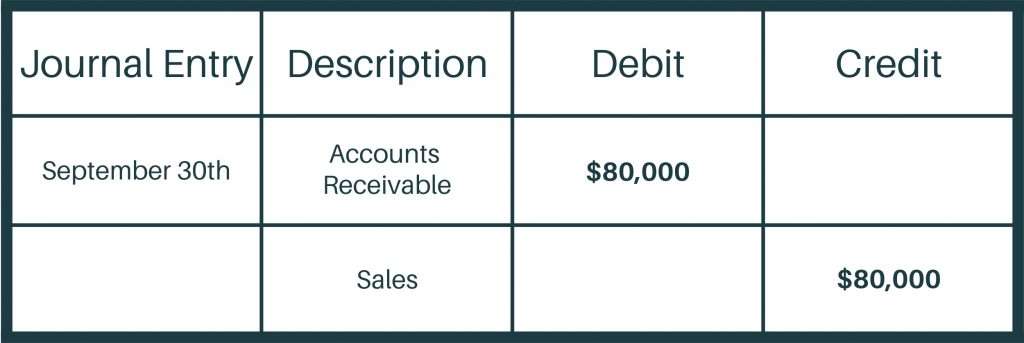

In this case, here’s the journal entry that Company B would record on September 14th:

Remember that because Company B’s functional currency is US dollars, they still record the transaction in USD even though they will be paid in EUR – the local currency.

However, let’s assume that the exchange rate changes when Company B closes the books at period end. For this example, we’ll say that when Company B closes the books on September 30th, 1 EUR is now worth 1.5 USD.

So even though the agreed-upon amount never changed, the value of the amount owed did change. In this case, the 80,000 EUR due (which, on September 14th, was worth 80,000 USD) is now (September 30th) worth 120,000 USD.

This is where the translation comes in. Due to the exchange rate fluctuation, the original 80,000 USD recorded on September 14th is now worth (translated to) 120,000 USD on September 30th.

To account for the gain or loss created by the exchange rate fluctuation, we need to create another journal entry at the period end:

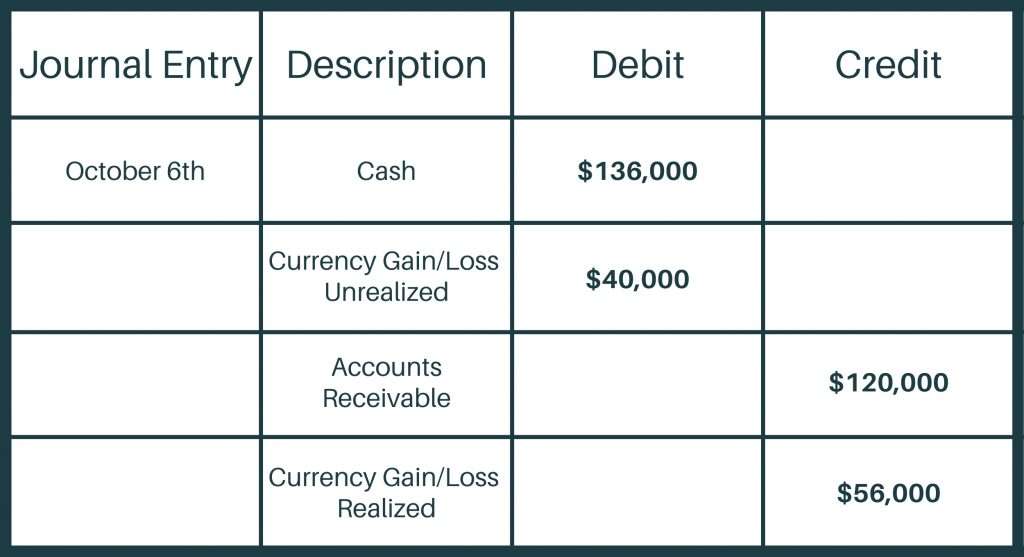

Now let’s pretend that Company A finally pays Company B on October 6th. We can call this the settlement date.

If the exchange rate on the settlement date for 1 EUR is now worth 1.7 USD, the unrealized gain is reversed, and the differences in value are recorded as a realized gain.

Therefore, this is how the settlement date journal entry would look:

Without accounting for these exchange rate gains and losses, the amount of operating net income reported or tax payable in a given period could increase.

This is why recording these unrealized gains/losses resulting from exchange rate fluctuations is vital. Unexpected tax liabilities like these can reduce a company’s overall profitability and negatively impact consolidated financial statements. Both of these financial positions can be problematic for stakeholders who are relying on the financial statements of companies with foreign currency transactions to make investments and strategic decisions.

Foreign Currency Translation and Remeasurement Methods

Instead of using the current exchange rate, companies may want to look at different rates when doing foreign currency translation.

Here are three different methods and when accounting teams may use them.

Current Rate Method

With the current rate method, most items on financial statements are translated at the current exchange rate. The same goes for the assets and liabilities of a company.

Since the current rate method typically sees the most volatility in exchange rates compared to the other methods, gains and losses resulting from this translation method are reported on a reserve account. They don’t appear on the consolidated net income account.

Temporal Rate Method

Also known as the historical method, this translation method adjusts income-generating assets on a company’s balance sheet and related income statement items using historic exchange rates.

The historical rates are from transaction dates or from the date the company last assessed the account’s fair market value.

Monetary-Nonmonetary Translation Method

This translation method is used when foreign operations are highly integrated with the parent company.

Monetary account items, such as cash and accounts receivable, are translated at the current exchange rate, whereas non-monetary accounts are translated at a historic rate. Non-monetary items can include inventories and properties.

Foreign Currency Translation Process

The steps in the foreign currency translation process are as follows:

Step 1: Choose a Functional Currency

Companies must choose a functional currency for reporting.

The functional currency is the primary currency the company uses for most of its business transactions. For example, this could be the currency of the country where the company’s main headquarters are located or where their primary operations are.

This choice can be difficult when a company conducts an equal amount of business in multiple countries. However, once the functional currency has been selected, changes should be made only when there’s a significant change in circumstances.

Step 2: Translate the Financial Statements Into the Functional Currency

All financial statements must be presented using the reporting currency. This is the currency a company uses to report its financial statements in.

The financial statements are translated into domestic currency by translating the income statement. According to the FASB ASC Topic 830, income transactions must be translated at the exchange rate when the transaction occurred.

GAAP regulations require items in the balance sheet to be converted per the rate of exchange as of the balance sheet date. In contrast, income statement items are translated according to the weighted average exchange rate.

This can get quite complicated, so always be sure to consult your applicable accounting standards.

Companies must keep a close eye on the dates the transactions occurred. Although most currency translations occur at the year-end, the exchange rates are sometimes determined by the transaction date. Again, bank statements and income records should always be kept up to date to help companies to determine the correct exchange rates.

Step 3: Record Translation Gains and Losses

The gains and losses arising from foreign currency transactions that are recorded and translated at one rate and then result in transactions at a later date and different rates are recorded in the equity section of the balance sheet.

Here’s an ultimate guide on how to complete foreign currency translations in SoftLedger.

Automate Foreign Currency Accounting Today!

If your company frequently processes foreign currency transactions, it’s often time-consuming and can cause executives to make financial decisions based on dated financial reports.

To solve this problem, we built SoftLedger to automate the entire foreign currency translation process.

To see for yourself how SoftLedger can improve your team’s efficiency, schedule a demo today!

Best Multi-Currency Accounting Software

Guide to Subsidiary Accounting: Methods and Examples

Foreign Currency Revaluation: Definition, Process, and Examples