Cost basis for crypto is a critical number your team needs to know for your accounting processes.

It plays a major role in calculating gains and losses and impacts your taxes.

So if you aren't accurately tracking the cost basis for each transaction, you could find yourself in serious trouble with the IRS.

To help you out, this post discusses what cost basis is, how to use it to calculate gains and losses, and general best practices.

Cost basis is simply the purchase price when you acquire the crypto asset. If you paid USD 20,000 to acquire one bitcoin on August 1st, the cost basis would be USD 20,000.

The cost basis is important because it's essential for calculating the gains and losses.

The formula for calculating a gain or loss is simple:

Cost Basis - Sale Price (Fair Market Value) = Gain/Loss

While determining the cost basis for a particular coin is pretty straightforward, calculating gains and losses can quickly become complicated. This is because the price of crypto is extremely volatile. So when you sell crypto, which cost basis should you use to calculate the gain or loss?

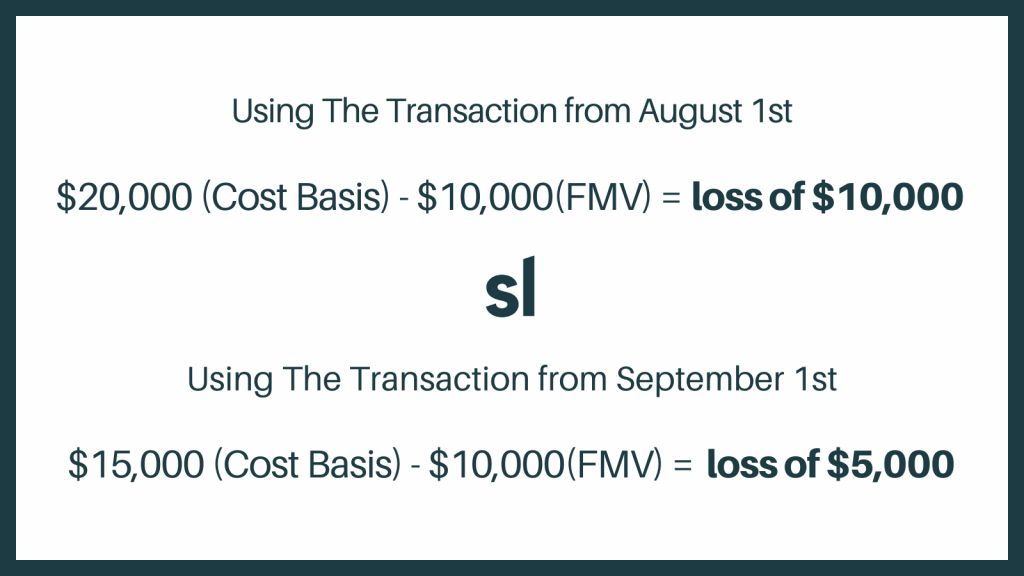

For example, you might purchase one BTC for $20,000 on August 1st and another BTC for $15,000 on September 1st.

There are tax advantages to calculating the loss with the first cost basis (from August 1st) as that shows a much larger capital loss than the second cost basis (from September 1st). However, you can also land your company in serious trouble if it’s obvious you’re evading crypto taxes.

This leads us to the next question:

There are several different calculation methods, including:

In general, the FIFO methodology is the most widely accepted calculation method.

Some parts of the world also accept the weighted average method. Although, FIFO is still the most common and highly recommended crypto cost basis method.

With the FIFO methodology, the sale price is compared to the earliest cost basis to calculate the gain or loss.

So using the example mentioned earlier, the gain/loss calculation using the FIFO method would use the cost basis recorded on August 1st because it was the first transaction recorded.

However, we still often have people ask if they can use any other cost basis methods. The most common question is "can I use HIFO for cost basis in crypto?"

HIFO (highest in first out) is the most advantageous cost basis method for tax purposes as it minimizes capital gains. This is because it compares the sale price of your cryptocurrency to the most expensive cost layer.

For example, let’s say you purchase Ethereum for $10,000 on Jan 1, $20,000 on Feb 1, $25,000 on March 1, and $15,000 on April 1. Then, you sell one Ethe for $20,000.

In that case, you would record a loss of $5,000 using the HIFO method because you would use the highest traction of $25,000 from March 1st to compare the sale price of $20,000.

However, HIFO is not a recommended crypto accounting method. Using it could land your company in trouble with the IRS as it's clearly minimizing capital gains tax.

For this reason, we recommend only using the FIFO method when calculating your cost basis.

In the simple example provided above, calculating the cost basis is relatively simple.

However, if your company has hundreds or even thousands of transactions per week (or day), it can quickly become cumbersome (if not impossible) to manually calculate the cost basis for each transaction.

Even if the team does manage to calculate the gain/loss manually, it's very likely that errors will creep into the calculations and could throw off the end number.

If you're using an SMB accounting software like QuickBooks or an ERP system like Sage or Netsuite, you can purchase a crypto add-on (usually an adapted tax reporting tool) to help you automate some of these calculations. However, you'll still have to manually export and then re-import the data, which can be cumbersome.

In addition, you might have to record the crypto transactions as foreign currency in your general ledger as most crypto transactions involve up to eight or nine decimal places. For example, we've seen some companies use the Zimbabwe currency to record their crypto transactions.

We felt this pain and therefore decided to build a single general ledger accounting software (SoftLedger) that seamlessly integrates your crypto accounting with the rest of your accounting.

Best of all, it automatically records the cost basis for each transaction and automates the gain/loss calculation for you.

First, SoftLedger automatically records the cost basis for each transaction. Meaning that when transactions are entered into the system, the cost basis is recorded at the price it was traded. SoftLedger also adds a date/time stamp for each transaction.

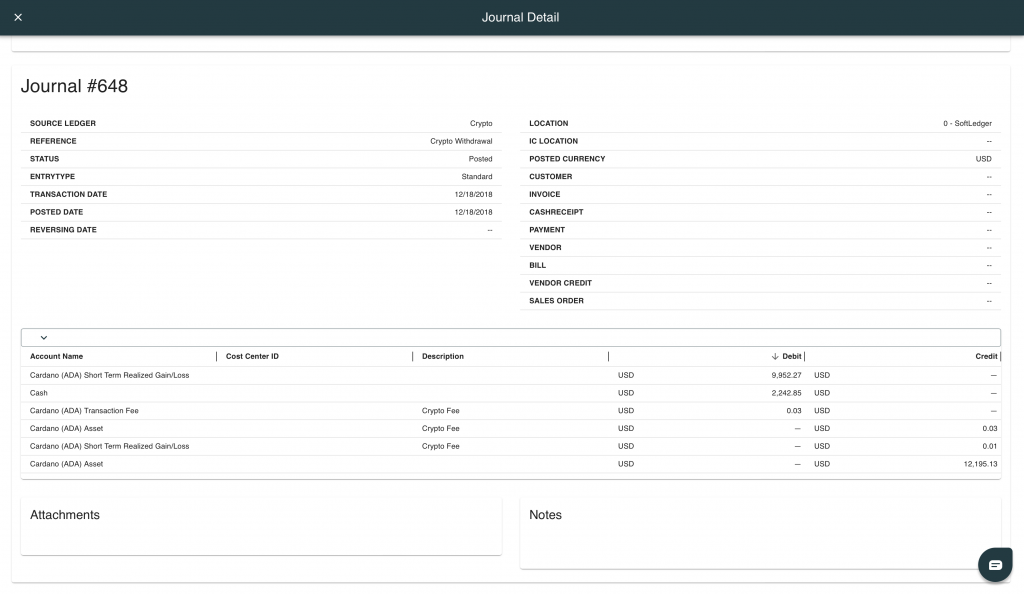

If you sell some of your cryptocurrency, SoftLedger already has the cost basis for each transaction and can automatically calculate the gain or loss using the FIFO methodology.

The system even automatically gives you the total gain or loss and even creates the journal entry for you:

So from the user’s perspective, when a new transaction enters the system, all you have to do is enter the most recent transaction, and SoftLedger will calculate the cost basis and record a journal entry with the corresponding gain or loss in seconds.

This means you never have to perform a single calculation or enter a gain/loss journal entry. SoftLedger does it for you.

You'll also always have an accurate list of the cost basis for each transaction and can produce an accurate audit trail in seconds.

All of your crypto accounting also seamlessly integrates with your general ledger software, so you'll never have to purchase a separate crypto tool.

Manually tracking cryptocurrency transactions is time-consuming and risky as it's easy to make a calculation error.

That's a key reason why we built SoftLedger to be a crypto-native tool that automates crypto accounting processes for you.

To recap, here are just a few things SoftLedger does for you automatically:

SoftLedger is also very flexible and designed to adapt to the ever-changing landscape of cryptocurrency. For example, we enable you to enter any exchange-traded coins and tokens (e.g., any coins or tokens on a platform like Coinbase), or you can enter your own custom coin.

If you'd like to learn more about SoftLedger and how it can help you automate accounting for cryptocurrency and other digital assets, schedule a demo today!

Crypto Tax Software: How To Tax For Crypto Gains and Losses

Accounting For Crypto Assets - Information and Examples for 2023